The Market

Last year’s average London vendor ‘doubled their money’

Research puts average 'profit' for those selling in 2016 at £256k after annual gains of £35k per year

RBKC investigates Chelsea chopper noise

'Groundbreaking' study to look at how homes are affected by flights to and from the London Heliport in Battersea

Spring Budget 2017: Hammond leaves the property sector alone

No mention of housing or stamp duty in the last Spring Budget...

Spring Budget 2017: Prime resi industry reactions

"A very modest Budget"

Required Reading: The Spring Budget 2017 for HNWs and business owners

Mishcon de Reya's comprehensive briefing note

‘Change in psyche’ in PCL after transaction rebound

'The market is now ready to move forward with greater confidence', says JLL

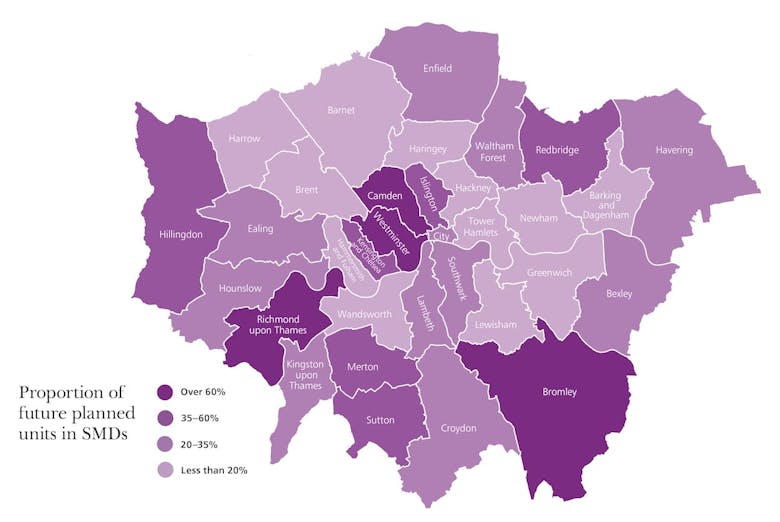

Small Packages: Which London borough is best for boutique developments?

Small and medium new-build schemes dominate London's housing development pipeline - but will only deliver one in five properties

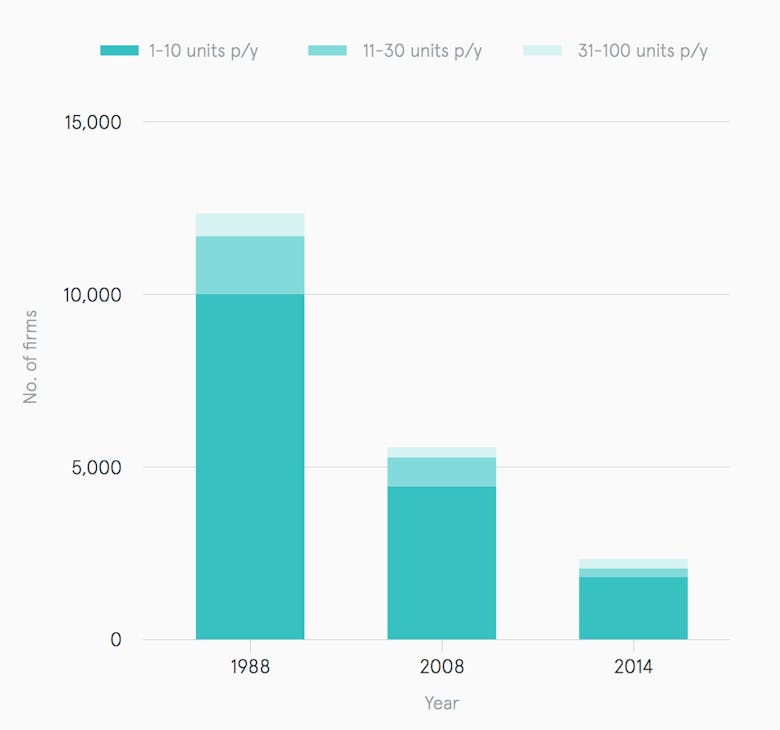

Four in five SME housebuilders have disappeared since the last housebuilding boom

Smaller developers need to be at the heart of Britain's housebuilding renaissance

Khan looks to Airbnb for short let policy lead

Mayor of London calls on letting agents to follow a 90-night maximum rule for short let properties

Investigation finds ‘less than a quarter of units’ at flagship London schemes sold to UK buyers

Transparency International analyses Land Registry records for 14 landmark developments

Budget 2017: Prime property industry pleas and predictions

No prizes for guessing what's at the top of the industry's wish list...

Back To Business: Office-to-resi conversions fall off a cliff

'When developers sit down and do the numbers, actually, office space is looking more promising'