The Market

‘We are due a significant correction in house prices’, claim academics

Two LSE Professors warn that the market could soon crash like the 1990s

The prime country house market is price sensitive, but moving

Prime Country House prices to rise by 1.5% this year, predicts Knight Frank

Airbnb checks out mansion market

Short-term rental giant looks to be plotting a new luxury offering...

Prime London house prices dropped by 1% in Q2 – Savills

The average prime London property price is now 5.3% less than at this time last year

Prime global rents ‘struggling to achieve growth’ – Knight Frank

Rents in 17 world cities nudged up by an average of just 0.5% in the 12 months to Q1 2017

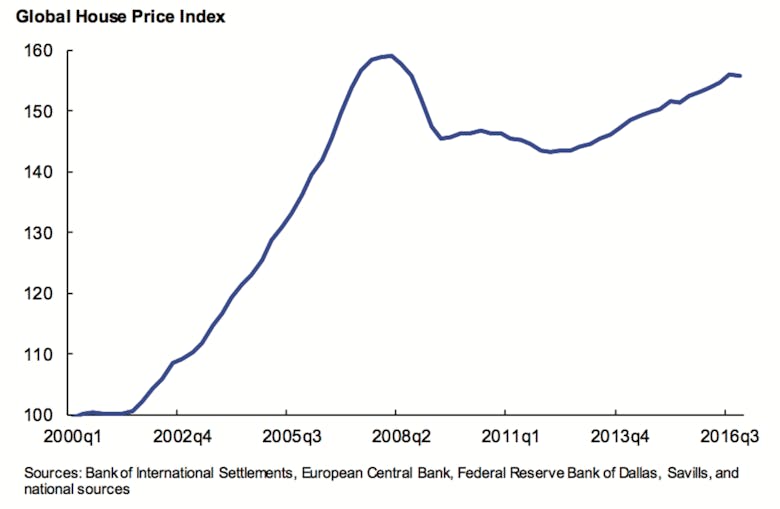

Global House Price Index ‘nearly back to its peak’ – IMF

Still no sign of a bubble, though

Letter From The Country: In fashion, the Cotswold way

Prime Purchase's latest recruit, Nick Croall, provides a snapshot of the perennially popular Cotswolds patch and talks us through what buyers are currently looking for...

May saw subdued spending and lending, say banks

House purchase and remortgage approvals by lenders dipped in May

Savills reports super-prime lettings deal surge

Agency sees a tripling in high-end transactions as new applicant registrations more than double

‘Buyers have shrugged their shoulders and are continuing with the process of buying’

Buyers and vendors 'not deterred' by the surprise hung Parliament result, says Jackson-Stops & Staff

Post-Referendum Performance: A Factor Perspective

Quantitative analysis shows what has happened to the market since the Brexit vote, and what the near future might hold...

New money laundering rules for estate agencies are now in play

"Stringent and targeted checks" into finances and ownership are now required by law