The Market

Post-lockdown buyers ‘acting more decisively’

'Despite a huge increase in the number of viewings, we are seeing properties going under offer much more quickly', reports Knight Frank...

Moving with the times: Why the lettings industry needs to adapt & evolve

Letting agencies will have to take significant steps to grow and advance in the new era, writes Giles Barrett - starting by putting tenants first, and ditching the uniform...

UK’s official house price index to return next week

HMLR has enough data to resume publication of the UK HPI.

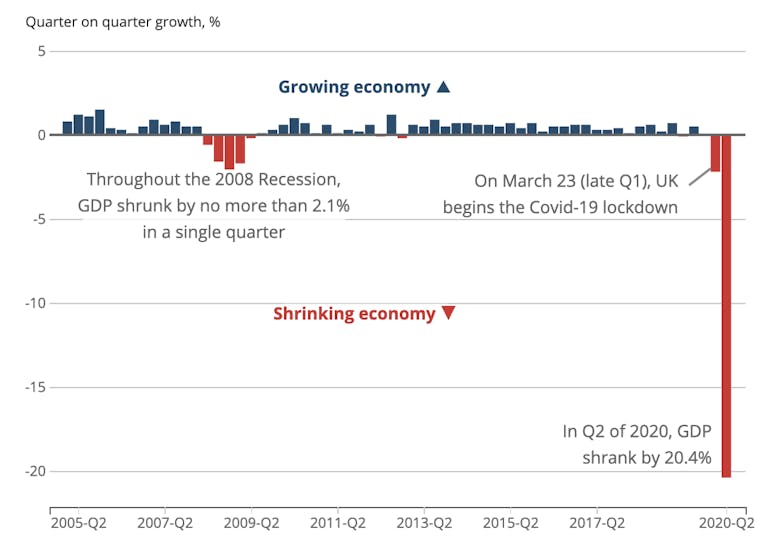

Surveyors warn of a ‘boom followed by a bust’ as the property market continues to rally

Housing market activity continued to 'gain momentum' in July, reports the RICS, but most surveyors 'do not expect this impetus to continue' for more than a few months...

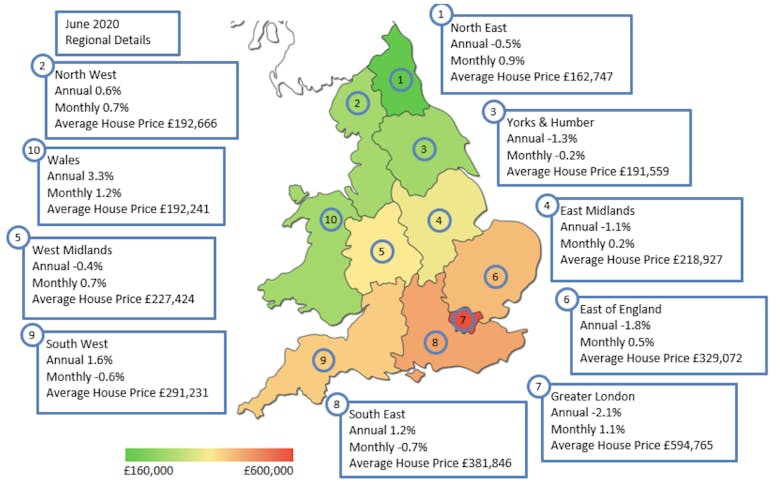

‘Lockdown lifestyle reappraisal’ sees rural & suburban prices rise while London continues to fall

Acadata's latest house price index tells of an "emerging new geography" for prices and demand - which may or may not be here to stay.

Property transaction numbers recover from lockdown lowpoint

The cumulative number of offers accepted in the UK since the start of the year is now above the five-year average, says Knight Frank.

Ranked: Which locations see the biggest average property price reductions?

Homes sold in the UK in the last year achieved an average of 95.8% of their initial asking price, according to some research by estate agency comparison website GetAgent.

One month on: New data shows the impact of the Chancellor’s stamp duty holiday

Rishi Sunak’s emergency measure to boost the housing market is working, says Knight Frank, and there’s an argument for making it permanent...

‘The best buying opportunity in nearly a decade’: Why PCL is well-placed to weather the storm

Despite well-documented near-term challenges, factors including current pricing, currency movements, interest rates and the recent stamp duty cut mean the London market is offering the best buying opportunity…

Market Snapshot: Prime London’s post-lockdown recovery

Property market activity in PCL is rebounding more slowly than in outer areas, reports Knight Frank, and average rents continue to fall.

Planning for the Future: Government reveals details of ‘radical’ reforms to create ‘a whole new planning system for England’

This is "radical reform unlike anything we have seen since the Second World War," declares the Prime Minister, Boris Johnson, as the Planning for the Future consultation opens.