The Market

House price inflation rises to highest rate since August 2007 – UK HPI

The annual rate of UK property price inflation climbed to 10.2% in March, according to official data.

April 2021 ‘may well mark the bottom of the prime London housing market’

The capital’s prime housing market has proven ‘remarkably resilient’, reports LonRes, and demand is expected to increase as the capital reawakens...

What’s next for prime markets? Eight factors shaping the top end of the UK’s property market

A year after the pandemic struck, Savills is "optimistic" about the outlook for Britain's prime property markets...

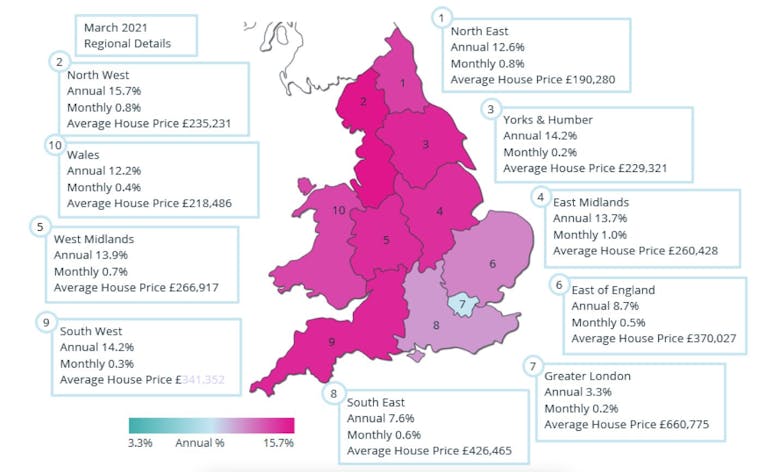

Heatmapped: North West overtakes South West as nation’s hottest property market

Annual price inflation in the North West is now running at 15.7%, reports Acadata.

What will raise sustainability up the agenda for house values?

Annabel King explores how sustainability is currently influencing valuations, and discusses what she believes will drive change as the UK pursues its ‘net-zero carbon’ by 2050 goal...

‘Best & final offers is becoming standard’ for top-tier country homes

“Best and final offers have become much more common place over recent months," say property agents in Devon and Cornwall.

Lettings market picks up around London’s major business districts

A ‘shift in mind-set’ has taken place, according to Knight Frank.

Average asking prices reach another record high

Three regions have seen asking prices climb by more than 10% in the last year-or-so, says Rightmove, while Greater London has seen prices flatline.

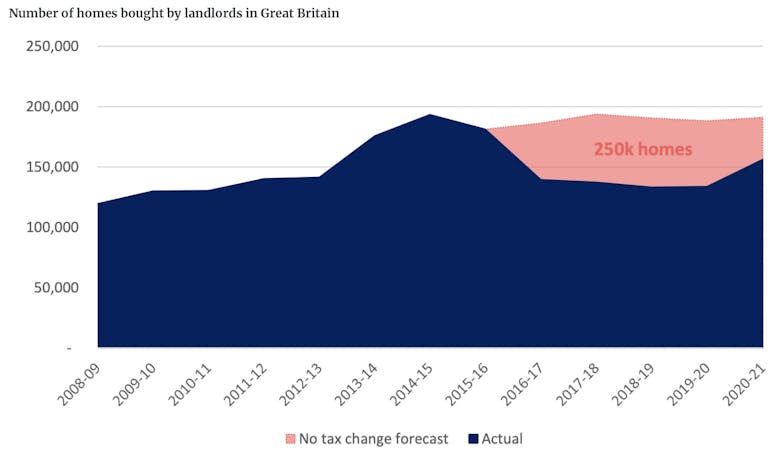

Five years on: How 2016’s tax changes have shrunk the buy-to-let market

“The tax changes introduced from 2016 onwards have undoubtedly taken the heat out of the buy-to-let market," argues Hamptons' research chief Aneisha Beveridge.

GBI chief: ‘The property sector is overwhelmingly a force for good’

In an impassioned defence of the property industry, James Raynor calls on the Government to ‘recognise that real estate is central to its plans for recovery, decarbonisation and levelling up’ as lockdown…

Global architecture firm draws up blueprint for the ‘English village of the future’

The post-pandemic exodus from cities has highlighted the inadequacies of the quintessential English country village, says Broadway Malyan, proposing a set of recommendations to prepare rural enclaves for…

AML warning for letting agents as HMRC deadline looms

‘The ramifications of not being prepared or compliant are serious and could result in an onerous fine or even worse the long-term reputational damage of a business,’ says AML specialist.