The Market

The average estate agent sold 19% more homes in 2021 than in 2020

Estate agencies sold an average of 46 properties in 2021 - seven more than in the previous year.

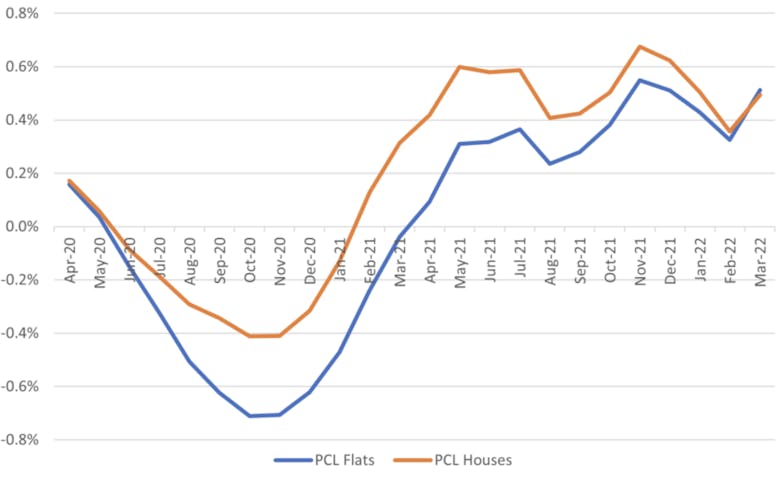

Return to the office revives market for PCL flats

Renewed appetite for apartments may tempt some reluctant sellers to list their properties, suggests LCP

Ranked: Britain’s best places to live in 2022

Prime property buying agency Garrington has rated and ranked nearly 1,400 towns, cities and villages across the UK - measuring a dozen criteria ranging from green credentials and architectural beauty to…

Talking Heads: What’s happening in the prime property market right now, according to top buying agents

Where is all the stock; what will happen to prices; and which areas are buyers flocking to right now?

International execs returning to PCL, reports agency

Corporate relocation searches were up by 150% in Q1, according to Winkworth, in a 'positive sign' for the sales market

‘Weary’ buy-to-let sector sees lending drop 8%

The buy-to-let sector is "a tad weary," says the boss of property lender Octane Capital, as a result of what he calls a "war waged on the nation’s landlords" since 2015.

Developers scale-back tall building projects in London

The number of planning applications to build skyscrapers in London has dropped by more than 13% in the last year, according to the ninth annual London Tall Buildings Survey by New London Architecture and…

‘The ball is still firmly in the seller’s court’ as the Spring property market kicks in

"Buyers are still predominantly paying asking price and above meaning the ball is still firmly in the seller’s court," says Propertymark in its latest monthly market update.

Ground rent ban comes into force in June

"This is an important milestone in our work to fix the leasehold system and to level up home ownership," says the Leasehold Minister, Lord Stephen Greenhalgh.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest market movements in less than five minutes, featuring data and analysis from LonRes, Hamptons International, LCP, Savills, Knight Frank & Rightmove

End of the Chain? A record three-quarters of buyers are now chain-free

"The current pace of the market has put buyers with a home to sell at the back of the queue," says Hamptons' research chief.

‘Market dynamics have changed and looking at past trends may no longer be helpful’ – Garrington

"The spring market is brisk and competitive," says buying agency Garrington in its latest summary of the UK's property market.