The Market

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Propertymark, Knight Frank, Hamptons International, Savills & more…

Developers under pressure to deliver as new-build reservations soar

Regional reservations were up 41% on pre-pandemic levels in the first few months of this year, but housebuilders are having a hard time keeping up with the demand

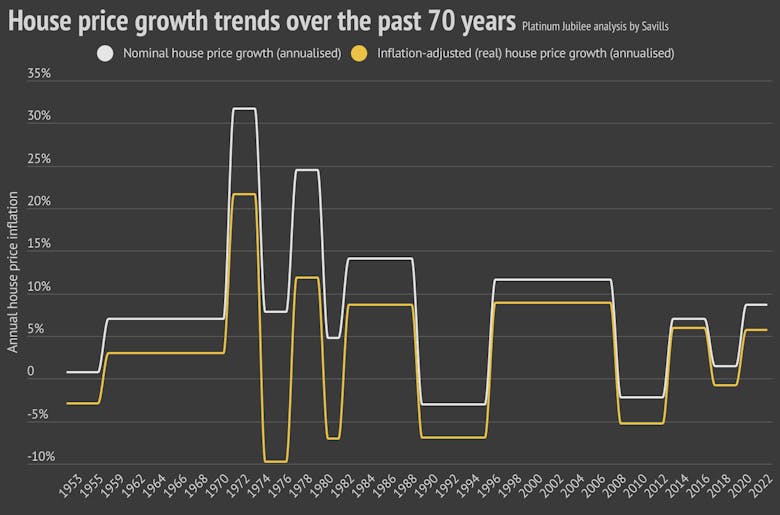

70 years of house price growth: How property prices have shifted since Elizabeth II was crowned

The Queen was crowned on 6th February 1952, when an average home cost just under £2,000. This is the equivalent of £56,000 in today’s money, and amounts to house price growth averaging 2.

Property as an inflation hedge? Maybe not…

"To predict what will happen to property prices, look at the amount of leverage," says Charlie Ellingworth, founder of buying agency Property Vision, as he warns that "residential property is not going…

Mortgage lending drops below pre-pandemic levels

Net mortgage borrowing and mortgage approval numbers are both now below their 12-month pre-pandemic averages, says the Bank of England.

House price growth to slow, but ‘risks of a correction have been overstated’ – Savills

Savills has upgraded its mainstream market forecasts for this year, predicting 7.5% growth through 2022 and 12.9% over the five years to the end of 2026.

‘Vicious circle of low supply breaks’ as more homes come to market

The number of new property listings jumped by nearly a fifth between January and April, reports Knight Frank - with rural areas leading the charge.

‘A perfect storm of garden desirability’: On the growing value of outside space

Buying agent Louise Ridings explores the capitalisation of garden space, and what buyers should bear inn mind when assessing a potential new home's outside space.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest market movements and commentary in less than five minutes, featuring data and analysis from Knight Frank, Winkworth, Zoopla, Glentree & more…

Zoopla predicts UK house price growth to slow to 3% by the year’s end

"Buyer demand remains high but there are now signs that market is softening," says Zoopla's research chief, as more vendors cut asking prices and deals take longer to materialise.

Talking Heads: Chelsea in bloom as buyers & tenants put down roots

As Chelsea basks in the spotlight of the world's most famous flower show, local agents explain why the area has returned to the top of the wish list for many prime buyers...

The Infrastructure Levy: A clearer direction on the future of Developer Contributions?

William Clutton of Iceni Projects delves into the government's proposed overhaul of the Community Infrastructure Levy and Section 106 Agreements, as outlined in the recently-published draft Levelling…