The Market

Waterfront price premiums rise around the world as demand surges

The average international premium for a waterfront property compared with a non-waterfront home has climbed to 40%, according to Knight Frank.

Ranked: London’s most active property markets

Croydon (CR0), Wandsworth (SW18) and Merton (SW19) are the most active London areas for home-buying activity, with each postcode seeing more than 60 homes sold each month.

High-end country estate market on a roll

Nine sales of £15mn-plus estates have been recorded across England & Wales so far this year.

‘Significant slowdown’ expected for prime London rents next year

Escalating costs of living and inflationary pressure are likely to slow the pace of prime rental price growth down in the coming months, says Savills - but the firm has still upgraded its five-year price…

Bank of England turns gloomier as base rate rises to 1.75%; how will the housing market respond, asks Tom Bill

Economists question the Bank’s latest forecasts while the direction of travel for mortgage costs is less open to debate, writes Knight Frank's head of UK residential research.

London’s sales pipeline swells as number of offers accepted hits ten-year high

Pipeline now stronger than it was in the final months of the stamp duty holiday in 2021, reports Knight Frank.

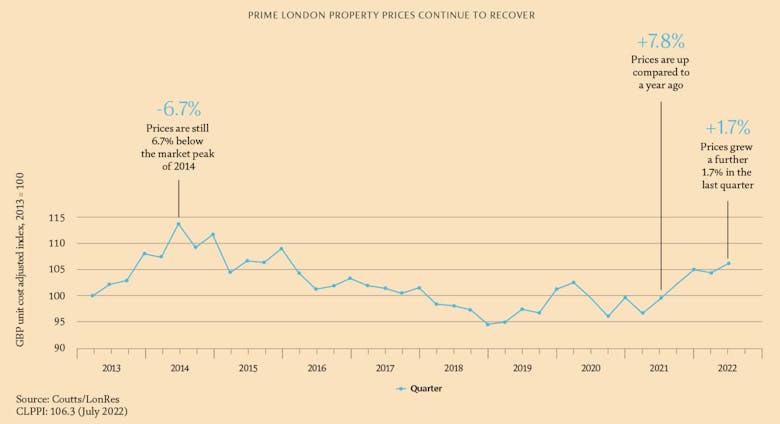

No sign of price slowdown in Prime London – LonRes

High-end market continues to hold its own despite wider economic context, with demand staying high and stock levels still low…

Monday Market Review: Key figures and findings from the last seven days (w/c 01.08.22)

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, Savills, Coutts, Zoopla, Knight Frank, London House & more…

Broadband, energy efficiency & pets are now top priorities for tenants

A survey by Carter Jonas has highlighted how the needs and wants of tenants have shifted through the pandemic.

Prime rental growth outpaces capital values in most global cities

“Megacities are once again thriving as tenants are drawn back to urban living after the lifting of lockdowns," says Savills, as prime rents climb in New York, Singapore, London and Los Angeles.

‘London’s prime property market is getting back on form’ – Coutts

High-society bank tells affluent clients that PCL is back in action.

‘Signs are already emerging that housing delivery rates could slow considerably’, warns Knight Frank

“New residential development is being constrained by a limited supply of land coming through the planning system.