The Market

Inflation-linked S106 payments ‘could be the straw that breaks the camel’s back for some developments’

"Some projects could become economically unviable if local authorities force developers to increase Section 106 agreements in line with runaway inflation," warns Boodle Hatfield.

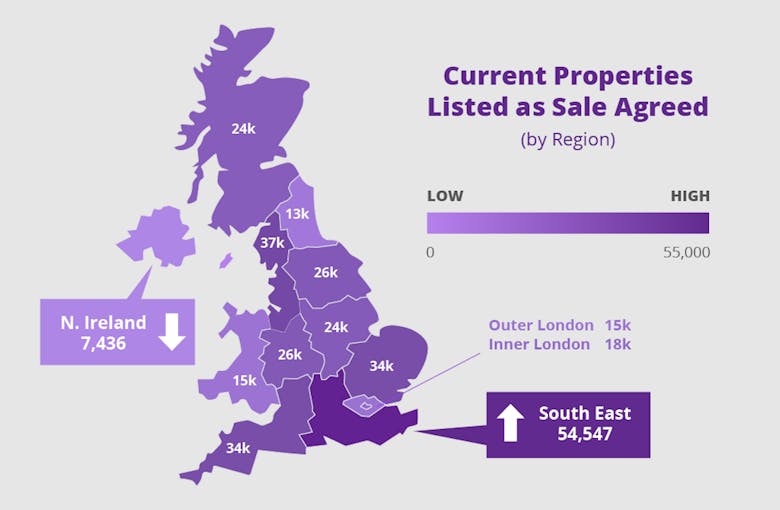

Balance returns to the housing market as new sales instructions climb

"We’re still a long way off a housing market crash, but things are showing signs of cooling somewhat," reports TwentyCi.

Buyer & seller sentiment ‘remarkably resilient’ as stock levels hit 15-month high

Property portal OnTheMarket is expecting the market to become less competitive as we head deeper into autumn, although there's no sign of a significant drop-off in buyer and seller sentiment just yet.

Pets in Properties: Shaggy dog stories & rental reform

Following the White Paper for the Renters Reform Bill, and the proposed new rules for tenants being allowed to keep pets in rental properties, law firm Boyes Turner has had a look into the current position…

Country house market ‘takes a breath’, but buyer appetite remains strong

Knight Frank conducted 16% fewer country house viewings last month than in a typical August, but accepted 33% more offers.

Chancellor Kwarteng to deliver ‘emergency mini-budget’ on 23rd September

The new Prime Minister has promised to cut taxes.

Immediate buyer urgency has stalled – Savills

Sellers will need to become 'much more realistic' in the short-term, warns agency.

Rental demand will continue to outweigh supply this year in Prime London – Knight Frank

'It won’t become a tenants’ market any time soon,' writes Knight Frank's Tom Bill, as the firm's latest PCL index tells of continued double-digit rental growth.

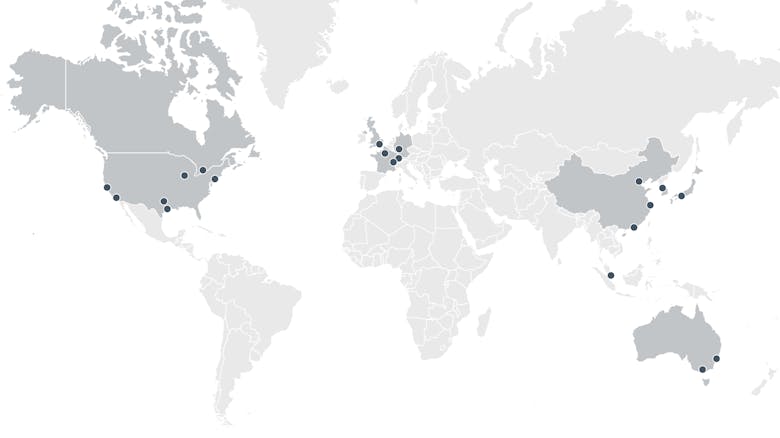

Ranked: The world’s millionaire capitals in 2022

London has fallen further down the wealthiest city rankings, with fewer millionaires now calling the UK capital home than New York, Tokyo and San Francisco.

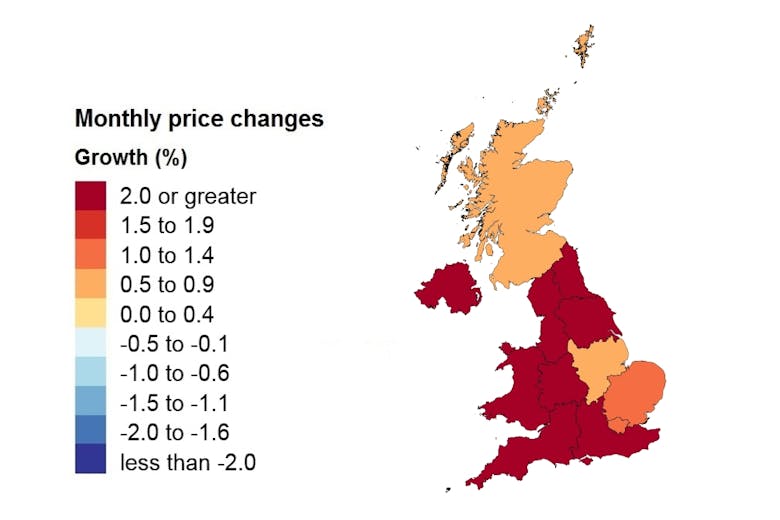

Annual house price growth jumps to 15.5%, the highest level since 2003 – UK HPI

Last month's step-up in the pace of property price inflation "tells us more about how a stamp duty holiday can alter the course of the housing market than where prices are headed next," suggests Knight…

Tom Bill: What does Liz Truss mean for the prime London property market?

'A short-term boost appears likely from a government already in pre-election giveaway mode,' writes Knight Frank's Tom Bill.

Ranked: The quickest months to sell a home

Analysis of Zoopla data by money.co.uk shows that April and May are the best months to market a property for sale.