The Market

Tom Bill: The impact of cheaper mortgages may eclipse house price declines

Effect will be more marked for those with higher loan-to-value ratios, says Knight Frank's UK resi research boss...

Former Housing Secretaries back report ‘demolishing housing market myths’

Former housing policy-makers Sajid Javid, Simon Clarke, Brandon Lewis and Kit Malthouse agree that housebuilding policies have not been good enough.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, Savills, Rightmove, Foxtons, OnTheMarket & more...

What 2023 has in store for the world’s leading city residential markets

17 of the 30 locations tracked by the Savills prime residential world cities index are expected to record slower growth in 2023 than in 2022, but 13 are forecast to equal or exceed last year's price…

Why Canada’s ban on foreign homebuyers is unlikely to affect housing affordability

A new act in Canada bans non-citizens, non-permanent residents and foreign commercial enterprises from buying Canadian residential properties;

London rents jumped 20% in 2022, and demand remains high

Demand for rental homes in London 'remains high and I do not see a great glut of stock on the horizon,' says Sarah Tonkinson of Foxtons.

High-end listings soar in London as ‘bumper’ market tempts vendors

New £5m-plus instructions in Q4 were 74% higher than the pre-pandemic average, reports LonRes

Property market continues to cool – RICS

The latest RICS data on residential property deals, demand, new instructions and prices all point to a continued market slowdown.

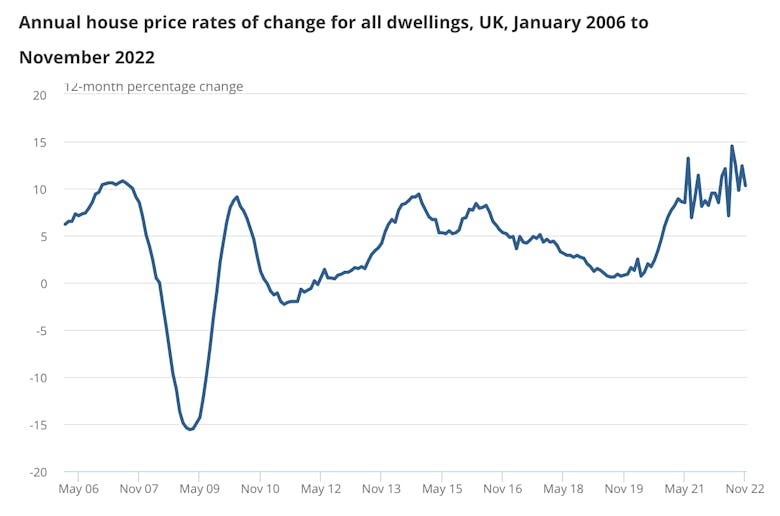

UK house prices dipped in November – official data

The average UK property price fell by 0.3% in November 2022, according to the official House Price Index, but London saw a 0.1% rise.

Policy Watch: Three big resi reforms to watch this year

2023 will see some major - and long-awaited - changes to the legislative landscape. Two lawyers look ahead to some key reforms that are likely to affect the residential property sector...

Buyers & sellers ‘get on with moving’ as sentiment holds up

60% of properties were SSTC within 30 days last month, reports OnTheMarket, up from 42% in November

Prime rental price growth slows as the market becomes ‘less frantic’

Savills expects prime London rental growth to calm from its double-digit run to +5.0% over 2023 and +3.0% by the end of 2024. The prime commuter belt is set for an even sharper slowdown.