The Market

Agreed sales tally recovers to pre-pandemic levels

Rightmove's latest data points to a return to some kind of normalcy for the property market...

Farmland values hit record high as investors pile in

Private and institutional investors bought a third of all the farms sold in 2022 – the highest level for at least a decade - and there's no sign of demand weakening.

‘The second half of 2023 is likely to be stronger than the first’ – Hamptons

Property market metrics are moving back towards 2019 levels, says up-market estate agency, as the latest data shows one in ten £1mn+ homes finds a buyer within a week of hitting the market.

10 Years of ATED: On the past, present & future of the Annual Tax on Enveloped Dwellings

Law firm Burges Salmon looks back at how the Annual Tax on Enveloped Dwellings (ATED) has evolved and affected the property market since being introduced in 2013, and considers what may lie ahead for the…

Westminster launches dirty money charter

Companies House is being 'played like a fiddle', says council as it vows to clean up 'haven for oligarch investors'.

London property demand boosted by ‘hybrid’ workers seeking a shorter commute

'Even with the new norm of hybrid working, the exodus from city centres has not been permanent,' says CBRE, 'and housing market activity indicates hybrid workers are placing greater value on shorter commute…

Worth the Works? Why unmod homes can still make sense for HNW buyers

New-build turn-key stock has its merits, but there are some wonderful unmodernised properties that are not being snapped up as few buyers have the appetite or vision to take them on, says Lucy Worcester.

Ranked: Britain’s fastest-moving property markets

It takes far longer to sell a home in London than to find a buyer in Scotland, says Rightmove.

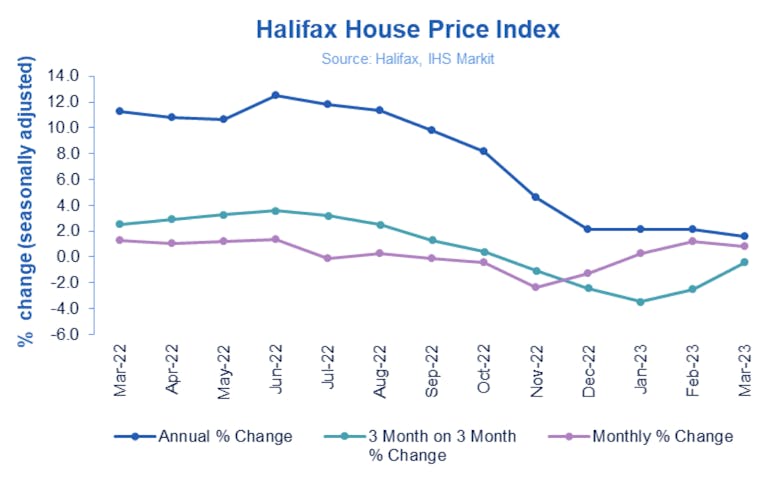

Industry reacts to the latest house price index, as prices rise again

Halifax's March data suggest a return to 'relative stability in the housing market'.

Ranked: Britain’s most expensive seaside towns in 2022

Salcombe has overtaken Sandbanks to become the UK's priciest coastal enclave to buy a home.

Housing market ‘defies expectations’ as transactions remain above pre-pandemic levels

Zoopla's latest data provide 'clear evidence buyers and sellers are striking deals at an increasing rate despite modest price reductions.'