The Market

How prime & super-prime markets are faring in London & the country

Charlie Wells & Ollie Marshall give us the lowdown on how things are shaping up in and out of town in 2023, and explain the different forces at work in each market...

London vendors ‘undeterred’ despite drop-off in buyer numbers

30-branch estate agency Chestertons recorded a 10% rise in new instructions last month, but says there are fewer purchasers entering the market.

Inflation data proves inconclusive for UK housing market

Financial markets expect further rate hikes but the significance for mortgages is less clear, explains Tom Bill.

£1mn-plus market stays strong in UK’s ‘most searched-for’ region

High-end homes in Scotland continued to attract strong interest and premiums in the first half of 2023, reports Savills

‘Only the more serious homebuyers & sellers are remaining proactive active in the market’ – Propertymark

The number of property viewings has plummeted, reports estate agency trade body.

Currency Matters: Why is GBP struggling to get going again & what does it mean for prime property?

With no end in sight for the current uncertainty, David Huggett explores the important relationship between currency and real estate markets.

Jo Eccles: Landlords coming under pressure face a stark choice

The founder & MD of Eccord, which manages £1.5bn of resi property in PCL, explains why the challenges facing landlords right now can’t always be resolved with rent increases alone...

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Rightmove, Foxtons, LonRes, UBS, Knight Frank, Acadata & more...

Prime London rental stock is still in short supply

Even after a 25% increase last month, available stock levels remain around 57% below the typical pre-pandemic level for this time of year, reports LonRes.

August sees ‘much larger than usual price drop’ – Rightmove

Average UK asking prices are now 2% lower than at their peak in May - but remain nearly a fifth higher than in August 2019.

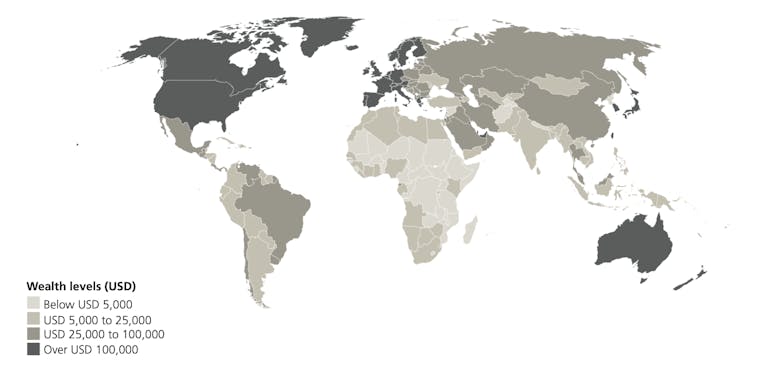

Global wealth has fallen – but is set to rise by 38% over the next five years

World wealth and millionaire numbers declined last year, but economists expect growth to return soon.

Deals drying up in Prime London as sales market goes into holiday mode

Last month's activity was on the low side, even by July standards, and there are signs the £5mn-plus market is finally beginning to buckle.