The Market

Autumn Statement 2023: Chancellor cuts taxes & pledges planning reform

Measures announced in Jeremy Hunt's 'Autumn Statement for growth' include a new Permitted Development Right that could allow the conversion of any house into two flats, provided the exterior is unchanged.

The off-market arena isn’t about working in the shadows…

...it's about the art of the deal, writes Anderson Rose's Jon Byers...

‘Too soon to call an end to the house price correction’, say economists

Britain's housing downturn 'has some way to run,' says Capital Economics.

Prime London Property Market Snapshot: Week 46, 2023

Deal numbers are down again in the capital...

Leasehold reform plans could boost property prices by up to 10%

Leasehold reform proposals 'come with large unforeseen consequences regarding affordability and pricing within the leasehold market,' warns Knight Frank.

Home-buyers are ‘sensing that the window of opportunity to negotiate significant discounts may narrow soon’

'Increasing levels of pragmatic buyers are seemingly prepared to offset short-term higher borrowing costs for generous savings off purchase prices', says buying agency Garrington.

Tom Bill: Lending outlook improves but risks will remain in 2024

Psychological milestones will be important for the property market as mortgage rates continue to fall, writes Knight Frank's head of UK resi research.

Winkworth: What the Chancellor must do in the Autumn Statement

Estate agency bosses Dominic Agace and Adam Stackhouse weigh-in on what Jeremy Hunt could and should announce in Wednesday's fiscal event.

Most UK housebuilders are now offering non-cash perks to incentivise buyers

In a tough market, property developers are looking beyond pricing to attract would-be home-buyers.

Rural Retreats: Ranking England’s most popular, most affordable, and most aspirational country house locations

Jackson-Stops has looked into country house buying trends to identify England's rural retreat hotspots - and track how things shifted through the pandemic years.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Foxtons, Knight Frank, LonRes, ONS & more...

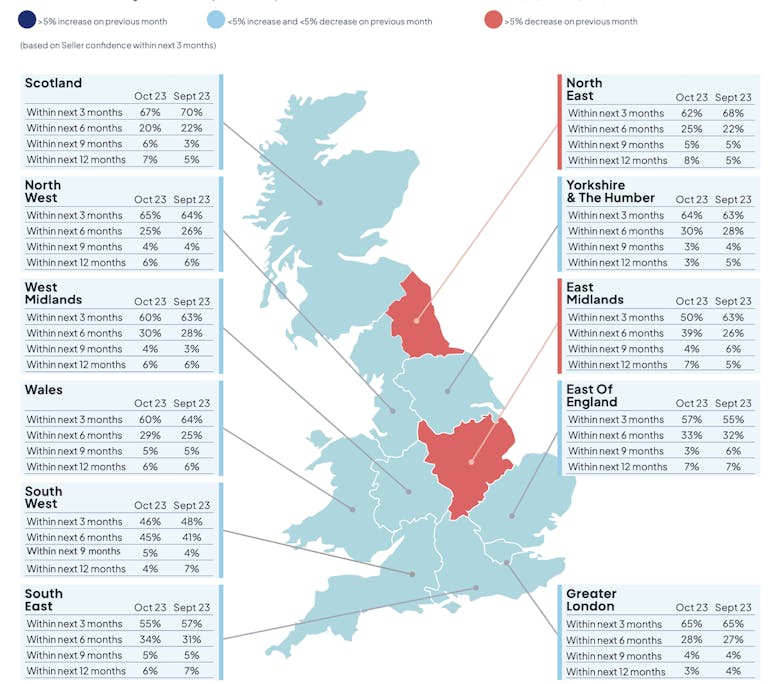

OnTheMarket: Pause in interest rate rises has reinforced market stability & buyer confidence

'People are breathing a sigh of relief,' says portal, although sentiment has dropped off significantly in some parts of the UK.