The Market

Prime London Property Market Snapshot: Week 15, 2024

Fresh LonRes data point to a spike in prime London properties going under offer following the Easter break, coinciding with a sharp increase in price reductions and new instructions.

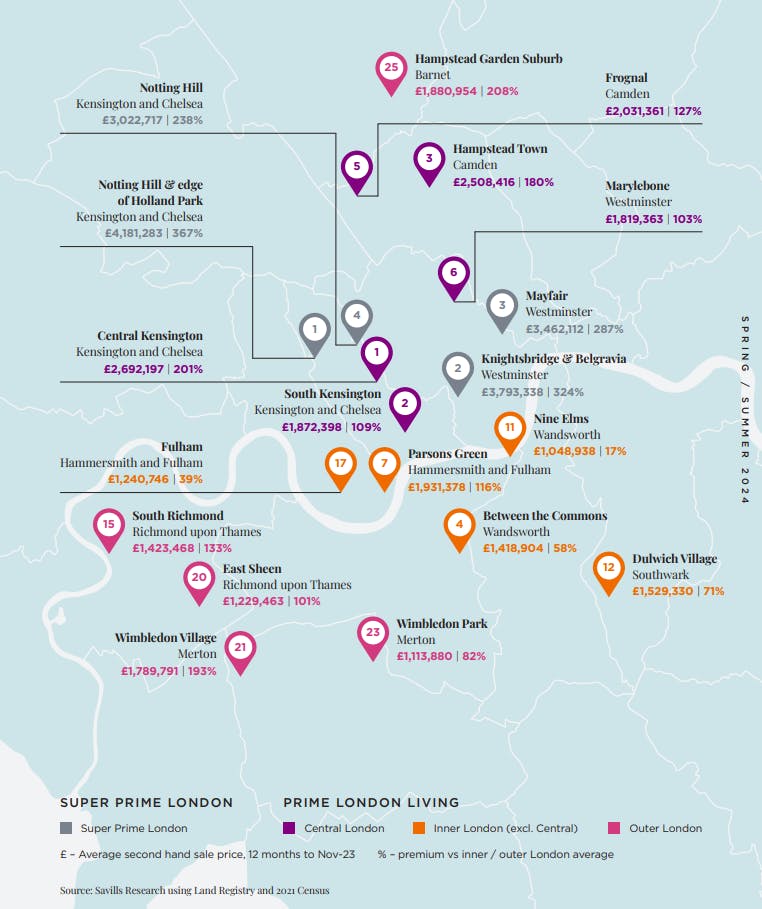

Revealed: London’s ‘most desirable neighbourhoods’

Savills has used socio-economic and health data from the Census alongside house price records to rank the capital's top enclaves for prime and super-prime property buyers.

Jennet Siebrits: Are homeowners right to feel brighter this year?

CBRE's research chief explains what the firm's latest consumer survey tells us about sentiment, spending and savings patterns & expectations for the year ahead.

Confidence slowly returning to the market – Acadata

Affordability pressures expected to ease but buyers 'cannot afford to throw caution to the wind'

London vendors holding out for ‘spring bounce’

The traditional seasonal upswing is taking a while to get going, but sellers are already less open to price adjustments, reports agency.

‘Noteworthy resurgence’ for global prime property price growth

Knight Frank’s latest international indices tell of renewed positivity across luxury housing markets.

Ranked: Britain’s most expensive streets in 2024

Rightmove's data shows a marked increase in buying interest in London's top-tier postcodes compared to last year, as the portal highlights addresses with the highest asking prices for sale and rent across…

Tom Bill: Slow recovery for UK housing market as it awaits political & economic clarity

Recent indicators suggest transaction volumes are rising as spring approaches but the pressure on pricing is downwards.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Knight Frank, LonRes, TwentyCi, Chestertons, the RICS & more...

Rental growth continues to cool as supply rises & demand eases

Average rents in Inner London have nudged up by just 0.4% over the last 12 months, while the national average has climbed 6.7%.

Agency reports ‘strong start’ to Spring lettings market as landlords cut prices

Chestertons has seen a clear increase in demand from 'motivated' tenants in the last month.

Residential construction starts ‘nosedive’

Latest data 'paints a decidedly gloomy picture,' says Glenigan.