The Market

‘Bold’ price cuts spur London’s top-end buyers into action

Double-digit reductions on longstanding listings have resulted in three or four buyers competing against each other, reports PCL buying agency Eccord.

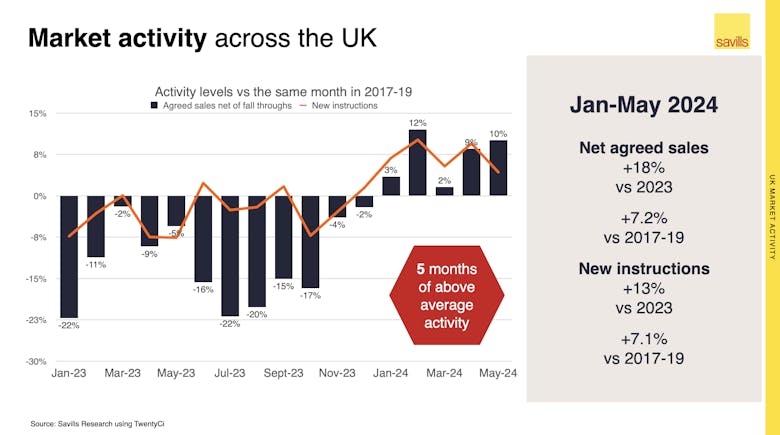

5 months of ‘above-average’ property market activity in 4 charts

Sales activity across the UK and in London in 2024 so far is running 7% above the average level seen from 2017 to 2019.

Luxury sales slow across the world’s top super-prime markets

1,618 $10mn-plus transactions went through across the 11 hubs tracked by Knight Frank in the 12 months to the end of Q1 2024, the lowest annual total in three years.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from the ONS, Zoopla, Rightmove, Knight Frank, Savills, Foxtons & more...

Ranked: England’s second home & property investment hotspots

Two prime London markets are driving second home market activity, says estate agency after checking Stamp Duty records.

One in six new property listings finds a buyer within a month

'There is a disappointing number of properties that have agreed to a sale in their first 30 days,' says GetAgent boss after checking Zoopla listings.

Four Policy Priorities: Rightmove suggests housing manifesto for the next government

Stamp Duty reform tops the property portal's wishlist.

Mortgage approvals are up 26% on the year

Mortgage approvals for house purchases are now 'back to 94% of their pre-pandemic level,' notes Savills, despite fresh Bank of England showing a slight month-on-month dip.

Savills warns of new homes shortage as buyer demand picks up

Agency urges developers with consented sites to 'push on' as outlook continues to improve.

Currency Matters: Keep calm and carry on

We can expect lots of 'noise' over the next few weeks, but there are three things that move markets significantly, explains David Huggett...

Sales listings rise to an eight-year high

Zoopla heralds 'renewed confidence amongst homeowners' as sales supply builds and house price growth nudges upwards.

Bridging lending activity holds steady as interest rates dip

More home-buyers are turning to bridging loans to prevent chain-breaks, while demand from businesses for short-term property funding doubled from Q4 2023 to Q1 2024.