The Market

Richard Rogerson: The lure of political stability?

As Sir Keir Starmer prepares to enter Downing Street as Labour's first prime minister in 14 years, buying agent Richard Rogerson runs through the hot topics for HNW clients, and London’s prime residential…

Election 2024: Property industry reactions to the election of a Labour government

Featuring commentary & insights from: Dominic Agace, Guy Gittins, Tim Hyatt, Trevor Kearney, Camilla Dell, Marcus Dixon, Lisa Simon, Becky Fatemi, Nicholas Gray, Will Watson, Geoff Wilford & more

Prime London rental value growth slides to three-year low

Almost all tenancies agreed in the last month above £1,000 pw have been below the asking rent or subject to a rent reduction, reports Knight Frank.

Election 2024: Starmer’s Labour wins the keys to Downing Street

New government has promised 'change', including planning reform and ambitious housebuilding targets.

It’s complicated: Grosvenor’s sustainability director on EPCs & listed buildings

Sorting out ambiguities in the EPC system is an example of what the industry means when it calls for certainty from government, writes Ed Green.

‘Weak pound’ argument for Prime London property starts to fade

Knight Frank's Tom Bill explains why international buyers might start to see their window of opportunity closing in the months ahead.

Global house price growth accelerates

82% of the 56 international property markets tracked by Knight Frank have seen property values rise in the last year.

Election result ‘will make no difference’ to most landlords, suggests survey

'It is unlikely that landlords will be running for the exits on Friday - no matter what happens', concludes Foxtons after quizzing over 1,000 property investors.

Rightmove warns ‘120,000 rental homes needed for normal price growth’ as rents climb to another record high

Property portal calls for government interventions to help narrow the gap between rental supply and demand.

Three agency chiefs on what the election result could mean for the Prime London property market

'The (surely) inevitable Labour victory has already been somewhat priced into the London residential market,' says Mark Pollack, concurring with Peter Wetherell, who suggests HNW clients have treated the…

Shaun Drummond: Comparing 2019 with today, you wouldn’t even know an election was on

The palpable sense of unease that gripped London's luxury property market in the lead-up to the last election has been noticeably absent this time around, reports Harrods Estates' head of resi.

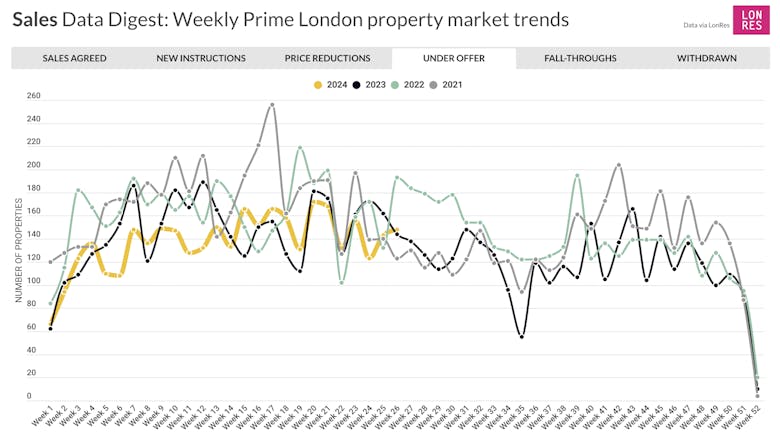

Prime London Property Market Snapshot: Week 26, 2024

While still quieter than in previous years, buying and selling activity in the capital's prime postcodes does not seem to have been massively affected by the imminent General Election.