The Market

PCL rental growth dips below 3% for the first time in three years

Just as the prospect of tax rises in the Budget is causing uncertainty in the sales market, Labour’s revival of the Renters Reform Bill is doing the same thing in the lettings market, says Knight Frank.

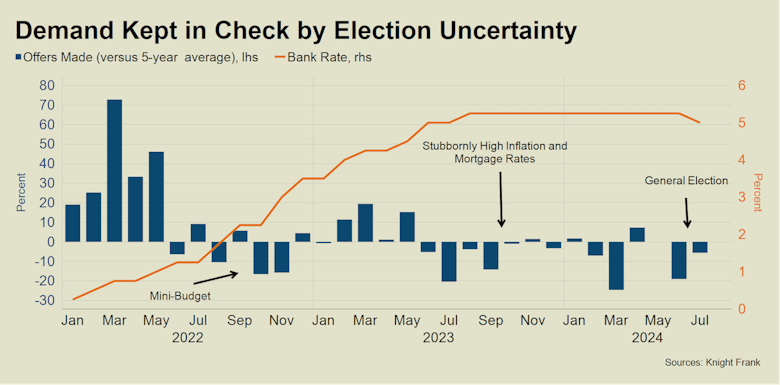

Offer numbers drop off in Prime London

Buyers in the prime postcodes were more focussed on their summer holidays than moving house in June and July, reports Knight Frank.

‘Shaken not stirred’: Ollie Marshall on why London remains one of the best haven bets out there

PCL house prices have not been tearing up the record books of late, but they are now at far less risk of a sharp recalibration and deleveraging than other markets, explains top buying agent.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from the RICS, TwentyCi, Knight Frank, Prime Purchase, Savills, Hamptons, Halifax & more...

Landlords face an ‘uphill battle’ to meet the government’s 2030 EPC target

Labour's plan to require all rental homes to achieve an EPC A-C rating by 2030 'is achievable at a stretch,' says Hamptons, but 'landlords need adequate time and resources to meet it.'

Larger homes see pace of rental growth ease

London's average monthly rent bill has risen by 3% in the last 12 months, while Northern regions have seen three-times that growth.

UK property market on a gradual, albeit uneven, recovery path – Acadata

Latest index shows prices are now just 1.3% lower than a year ago.

The View from France: Down but not out in Paris & London

'It sounds odd, but buyers expect a certain amount of craziness in Paris whether it’s a protest or Olympics controversy and investors seem unperturbed by the changes.'

Law firm warns some sellers could be in for a ‘nasty shock’ later this year

'I now firmly believe capital gains tax rates will be increased', says Matt Spencer of Kingsley Napley - so what are the options for those planning to sell in the near future?

Grey Belts & Golden Rules: What new planning reforms could mean for the property sector

From 'golden rules' and the new 'grey belt' to the return of housebuilding targets and the removal of 'beauty', Robert Garden & Grace Owen-Ellis of CMS UK explore how the latest consultation on a revised…

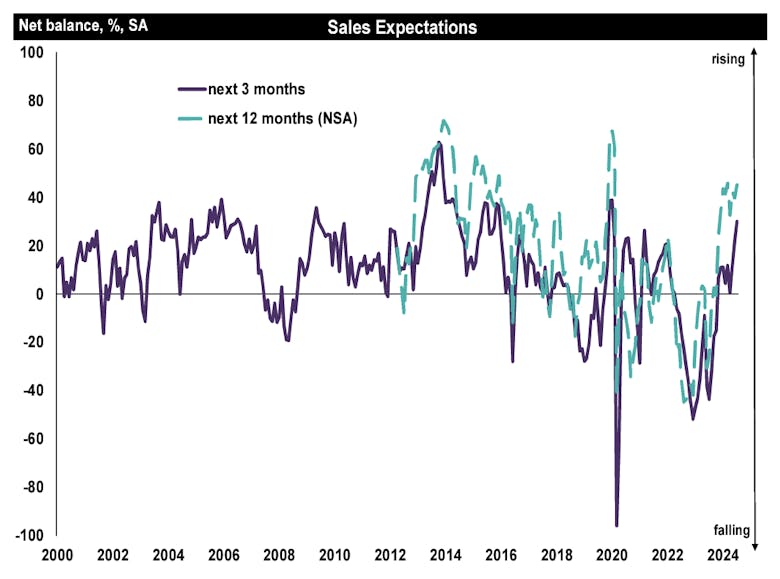

Property market got ‘a bit sunnier in July’ – RICS

Surveyors are feeling more positive about the sales market than at any time since January 2020.

Valuation Viewpoint: Exodus means property taxation

Wealthy people are leaving the UK & the government will need to make some tough choices as a result, warns Parthenia's James Wyatt.