Lettings

Average home seller profit tops £100k

'Even if prices do fall this year, it’s likely that over 90% of sellers will still sell at a profit,' says Hamptons' research chief.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Savills, Benham & Reeves, Rightmove, Knight Frank, the BoE & more...

‘Little sign of more balanced conditions’ in prime London’s lettings market

Rental supply and demand remain very mismatched in the capital - but Knight Frank suggests that 'the UK property market may finally begin the process of self-correction' later this year.

‘A very different market’ is emerging as we head into the new year – Garrington

A 'widespread repricing' is underway as home-buyer demand falls away, reports buying agency.

Property portal search trends return to pre-pandemic patterns

Searches for homes for sale in London increased by 9% from 2021 to 2022, says Rightmove, while searches for Cornwall and Devon dropped by 18% and 17% respectively.

Ranked: London’s top boroughs for housing, sustainability & quality of life

CBRE's latest 'Hot 100' report compares and rates London boroughs according to ten different lifestyle, sustainability and property market metrics...

Prime global rents continue to climb, but the pace of growth is easing

Luxury rental values in New York, Singapore and London have bounced back hardest from pandemic lows, according to Knight Frank's latest index.

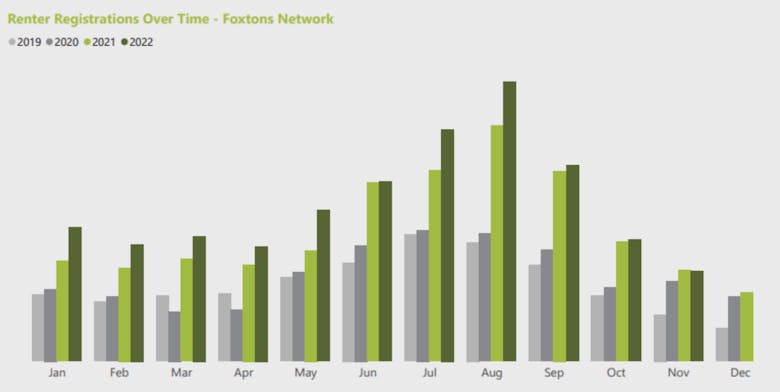

London’s lettings market cools, but average rents are still 20% higher than last year

Average rental prices in the capital fell by 3% last month, says Foxtons, in line with a normal seasonal slowdown.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, ONS, Propertymark, OnTheMarket, Knight Frank, UBS & more...

Savvy buyers snap up ‘Christmas bargains’ as competition drops by a third

'The sales market is firmly back in the hands of buyers,' says Propertymark.

Prime Central London agency reports ‘sharp rise’ in big-ticket short lets

Russell Simpson is putting 'more focus' on short-term rentals, after noticing a spike in demand across PCL.

Prime London property buyers ‘are hesitant but haven’t disappeared’

Knight Frank's latest analysis of the prime London property market tells of a clear slowdown in buying activity - but a price crash seems unlikely.