Lettings

Prime London Property Market Snapshot: Week 49, 2023

16% more sales were agreed in Prime London last week compared to the previous seven days, but 15% fewer than the corresponding week last year...

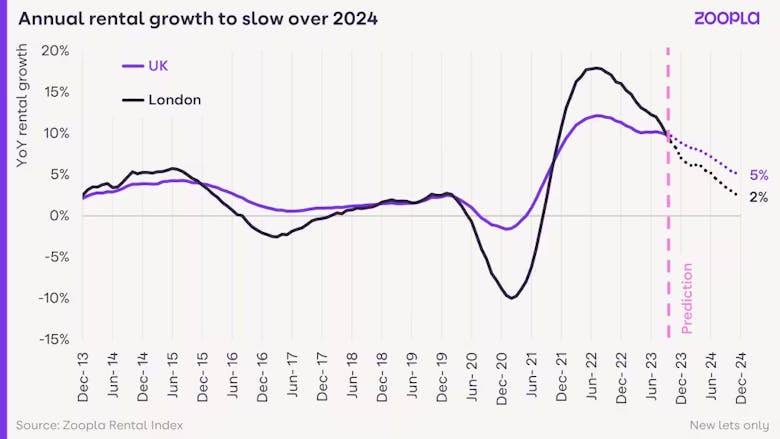

‘Rental growth has now peaked and we expect a major slowdown in 2024’, says Zoopla

'There are signs that the UK rental market will turn in 2024,' says Richard Donnell; 'rents are reaching the maximum affordable price and rental demand is starting to slow.'

Inner London rents have jumped 13.2% in the last year

Tenants across Great Britain paid a record £85.6bn in rent in 2023, says Hamptons - equivalent to the total value of all homes sold in London last year.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Reuters, Rightmove, Knight Frank, Beauchamp Estates, Hamptons & more...

Prime London Property Market Snapshot: Week 48, 2023

Deal numbers are down again in prime London, but sales supply has picked up.

Super-prime rental market booms as HNWIs hanker after NW London trophy homes

Conditions are 'highly-competitive' at the top-end, reports Beauchamp Estates, with multiple serious tenants often vying for the same property...and the victor happy to pay one or two years’ rent up-front.

‘Asking prices are still too high’, says Propertymark

Housing market activity is slowing down as seasonal trends re-emerge, says the estate agency trade body.

UK rents to keep on rising but will hit ‘affordability ceiling’ in 2025

Savills expects average rents to increase by another 6% next year, before the pace of growth eases as tenants are stretched to the limit.

Prime London Property Market Snapshot: Week 47, 2023

Deal numbers continue to slide in prime London, but the last week has seen a decent increase in new sales instructions.

House prices to rise in London next year, but dip across the UK – Chestertons

Recovery will be 'slow and steady rather than spectacular', says high-profile agency.

London’s super-rich turn to rental homes as ‘rival wealth hubs’ entice billionaire buyers

Fresh analysis by luxury estate agency Beauchamp Estates looks into the wealth and lifestyles of the global super-rich.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Beauchamp Estates, Savills, Knight Frank, Foxtons, the OBR, Jackson-Stops, OnTheMarket &…