Lettings

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from TwentyCi, Savills, Beauchamp Estates, LonRes, the ONS, Knight Frank, Foxtons, LonRes & more...

‘Significant uplift’ in number of landlords selling up

Interest rate hikes, rising costs & general uncertainty have driven a 'dramatic' rise in the number of previous rental properties for sale, reports TwentyEA.

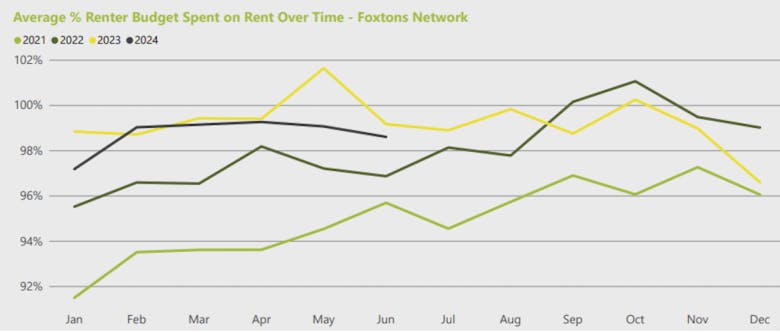

London rents hold steady as ‘peak lettings season begins in earnest’

Tenant demand has jumped 15% in the last month, reoports Foxtons, but remains lower than at this time last year.

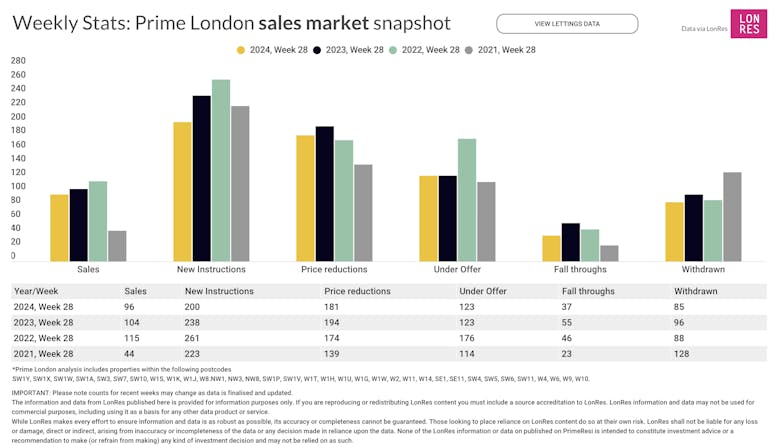

Prime London Property Market Snapshot: Week 28, 2024

Things continue to be relatively quiet in Prime Central London, with less home-buying and selling activity taking place in Week 28 2024 compared to the same seven day period in previous years.

Agency reports ‘record’ super-prime spending in Prime Central London as property market stays ‘surprisingly robust’

Wealthy buyers bought a record £439mn-worth of £10mn+ homes in the first half of this year, reports JLL, contradicting some rival market reports.

Prime London rental market slows after strong start to the year

LonRes recorded an annual decrease of 2.5% in lets agreed and a 5.1% fall in new instructions last month - while rental growth slipped to 0.4%.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, Rightmove, Beauchamp Estates, Benham & Reeves, HMRC, Foxtons, Savills, Knight Frank…

Prime rental market ‘falls back to pre-pandemic patterns’

Rents are still rising in London and the regions, but Savills warns of 'misalignment' between tenant and landlord expectations.

RICS heralds ‘post-election bounce’ for housing market

Surveyors 'have confidence in the newly elected Labour government,' concludes the Royal Institute as housing market optimism builds.

Prime London Property Market Snapshot: Week 27, 2024

The latest data suggest last week's General Election had little real effect on home-buying and selling activity across London's prime postcodes.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Savills, Knight Frank, Propertymark, Foxtons, Rightmove & more...

Analysis: Tom Bill on what a Labour victory means for the UK property market

Watch what the government says over the summer and what it does in its first Budget later this year, advises Knight Frank's UK resi research chief.