Lettings

Prime London’s rental market recovery stalls

LonRes data shows agreed lets were down by 18.9% last month, compared to December 2023, while new instructions fell by 26.3%.

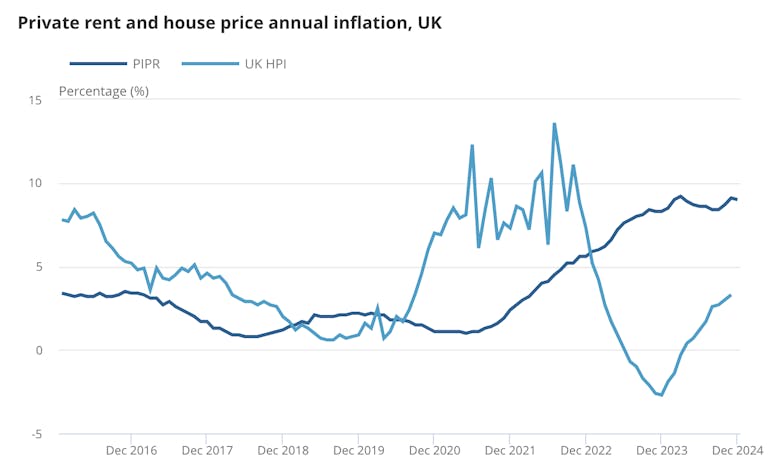

Industry Reactions: Official data show annual house price increases for eighth consecutive month

Analysis of the latest UK HPI from Foxtons, Garrington, OnTheMarket, Fine & Country & more.

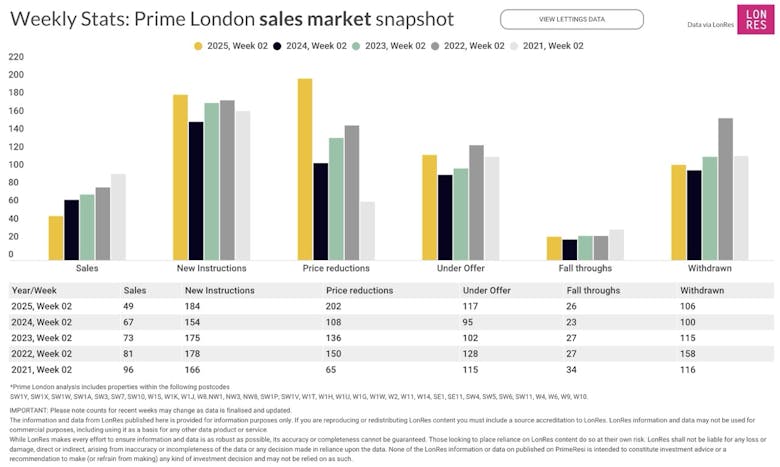

Prime London Property Market Snapshot: Week 2, 2025

Not the busy start to the year that some expected.

PCL rental values ‘largely flat’ as balance returns to the market

Latest numbers signal some 'much-needed stability' in the capital after several years of stock shortages, reports Knight Frank.

Monday Market Review: Key figures & findings from the last seven days

Your essential five-minute briefing on the latest movements and commentary, featuring data and analysis from Hamptons, Knight Frank, HMRC, Prime Purchase, Halifax & more...

Prime London Property Market Snapshot: Week 1, 2025

Early data suggests the slowest new year start in at least five years.

Wondering what to expect in 2025? You just need to look back at the final months of 2024

Guy Robinson of Strutt & Parker casts a weather eye over the property market's prospects in the year ahead.

Monday Market Review: Key figures & findings from the last seven days

Your essential five-minute briefing on the latest movements and commentary, featuring data and analysis from Beauchamp Estates, Hamptons, Rightmove, Savills, Knight Frank, Nationwide & more...

Forecast Round-Up: What’s in store for prime property prices in 2025?

It looks like a busy start to the new year - but the outlook for house prices is less clear.

Monday Market Review: Key figures & findings from the last seven days

Your essential five-minute briefing on the latest movements and commentary, featuring data and analysis from Lloyds Bank, LonRes, Foxtons, ONS, Zoopla, TwentyCi, Garrington, Savills & more...

Rents set to rise 3% in 2025, predicts Rightmove

More rental price inflation on the cards as tenant demand remains high.

London rents fell 2% in 2024, reports Foxtons

'Steady demand & rising supply' are shaping the capital's lettings market, says agency.