Lettings

Tenants reclaim some bargaining power in central London

8% of rental properties went for over asking in August, the lowest proportion since 2011

PCL rental values slide as stock floods the market

Annual rental growth dips to -4.1% as new instructions soar by 38.9%

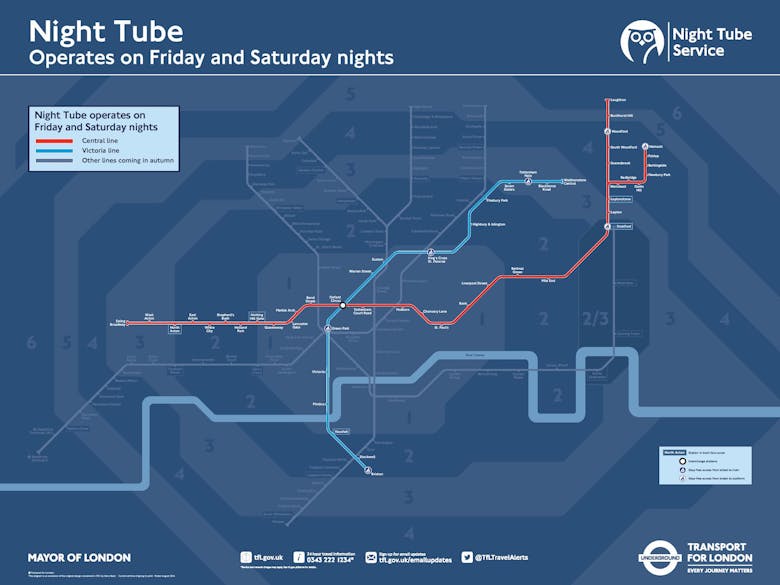

How the Night Tube will affect London’s local property markets

Will it really drive up prices on the participating lines?

Top-end property price drop ‘may well approach 5-10% before the year is out’

Some chunky falls in capital values are on the cards for the rest of 2016, says Cluttons

Little consensus on what’s in store for PCL property prices next year

An array of prime central London property pundits have released mid-year updates to their market forecasts

Why small is beautiful in the PCL rental market

Purely from a rental yield point of view, the highest performing property in Kensington and Chelsea is in fact the humble studio flat

Over Supply: PCL rental values hit hard as stock piles up

On an annual basis, values in Q2 were down by 4.3%, and by 8-10% in the upper price ranges

Rents drop in PCL but rise in Outer Prime London

The average weekly rent across Prime London increased by 1.6% (to £638 per week) in Q2, says Marsh & Parsons, but there were markedly different stories in the centre of town and the outer circle.

Work, Resi & Play: How London’s City & fringe market came of age

Average prices in the City itself have shot up by a remarkable 81% in the last five years, says CBRE

Central London’s ‘new-build crisis’: Over-supply and falling values are ‘a major concern’

Demand seems to be drying up for new-build apartments in central London as planning pipelines balloon, reports investment house London Central Portfolio, with a worsening case of over-supply - which the…

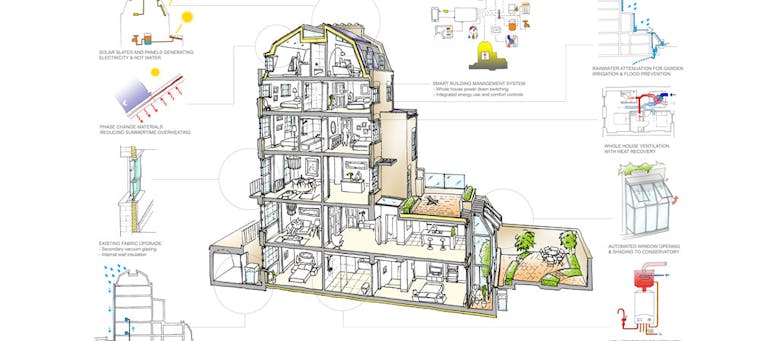

Grosvenor unveils ‘UK’s most sustainable period rental properties’ in Belgravia

119 Ebury Street was selected by Grosvenor, in collaboration with Westminster Council and Historic England, as a sort of testing ground to see just how green heritage buildings can go

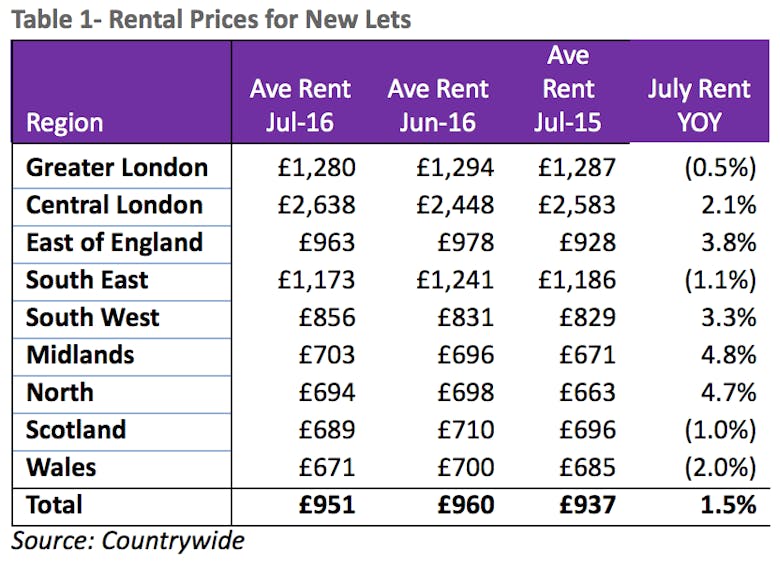

Massive stock surge hits rental prices; London records first annual drop in six years

A flood of properties has hit the lettings market over the last year and it's having a big impact on prices, according to Countrywide - London has just recorded the first annual drop in rents in six…