Lettings

Ranked: Britain’s top ten buy-to-let hotspots

Lendinvest index compares yield, capital gains, rental price growth and transaction volumes to assess performance

Watch: LonRes Q4 Lowdown

Marcus Dixon sums up an eventful three months in under four minutes

How renting can fix the UK’s ‘broken’ housing market

Including three scenarios where renting is financially better than home-ownership

Record number of landlords buying in cash

'On average landlords sell a home once every 17 years meaning as prices have increased, a significant amount of wealth has built up in the sector'

Mapped: Airbnb landlords by London borough

Research reveals spread of active listings and average day rate

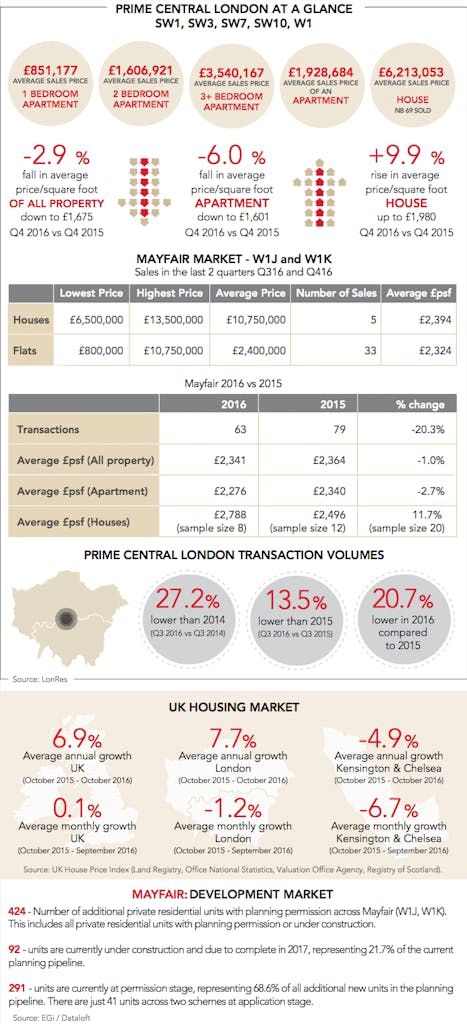

High-end rentals soar in PCL as buyers hold fire

Number of properties let at £3k per week in Q4 was up 28% year-on-year

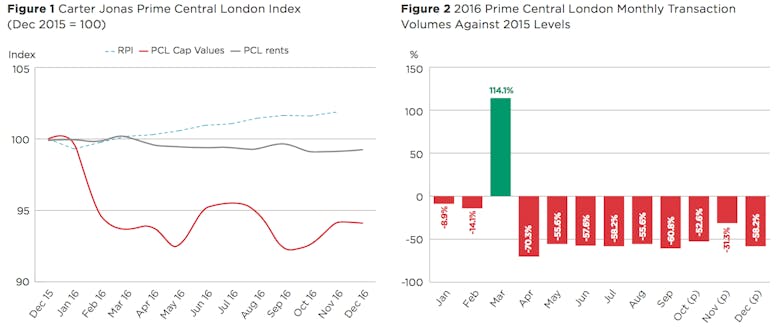

How the Brexit vote was ‘a surprise lifeline’ for PCL’s property market

Sterling's decline after the referendum result was behind a 16% jump in PCL transactions, says Carter Jonas

Build-to-rent needs a ‘turbo boost’ as supply shortage continues – RICS

Rent rises to outpace property price inflation over the next five years

Mayfair’s market at a glance, with insights on the sales and lettings landscape in 2017

Pastor Real Estate infographises property market trends in one of the world's most exclusive enclaves

US short let giant launches in London; goes on the hunt for blocks of rental units

National Corporate Housing plans to spend c.£20m on prime London apartments

Additional homes surcharge delivers £1,190m SDLT ‘windfall’

Number of levy-liable properties rises despite the additional 3% tax

Letting fees consultation earmarked for this Spring

Consultation to start sometime in March or April