Lettings

Summer Snapshot: Prime property markets in six charts

Average annual house price growth across the UK slowed to 2.1% in August, down from 2.9% in July, reports Knight Frank

Britain is now the ‘fifth worst’ European country for buy-to-let investors

Ireland maintains the highest rental yield (7.08%) in Europe for second year in the latest "European Buy-To-Let League" table

Letting fees ban is agent’s ‘primary concern’

42% of letting agents put the ban at the top of their To Worry About list

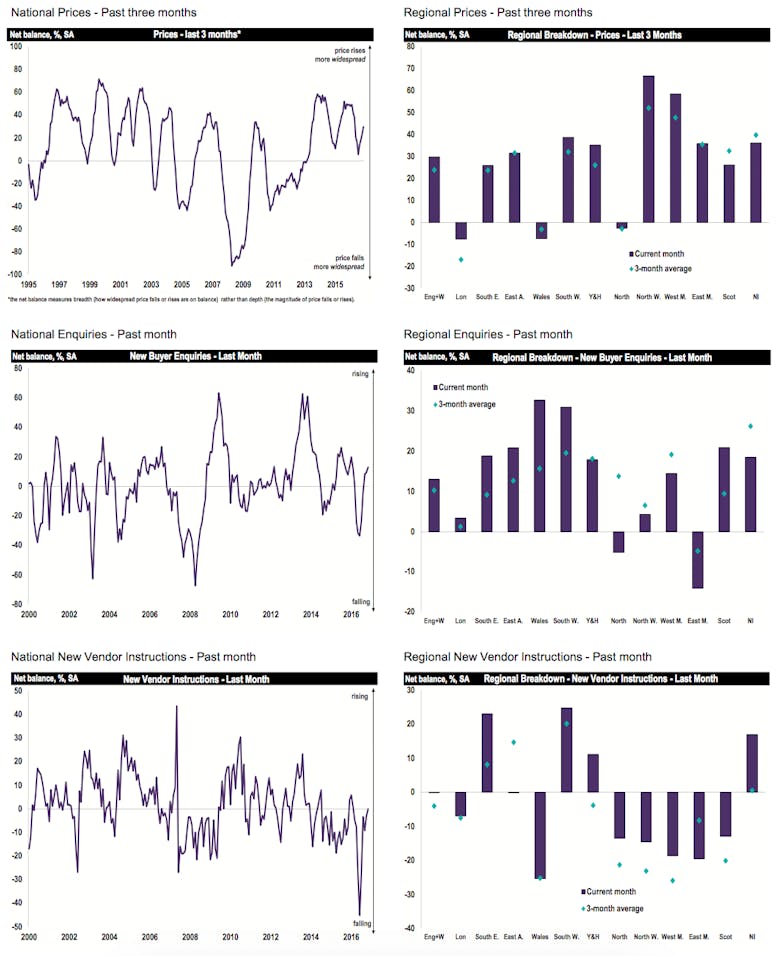

August sees central London’s property market at its ‘weakest since 2008’ – RICS

The UK property market is an 'increasingly mixed picture'

MPs to debate letting agency fees ban

Article updated to include a summary of proceedings and link to full Hansard records

How have prime residential yields performed in the last 12 months?

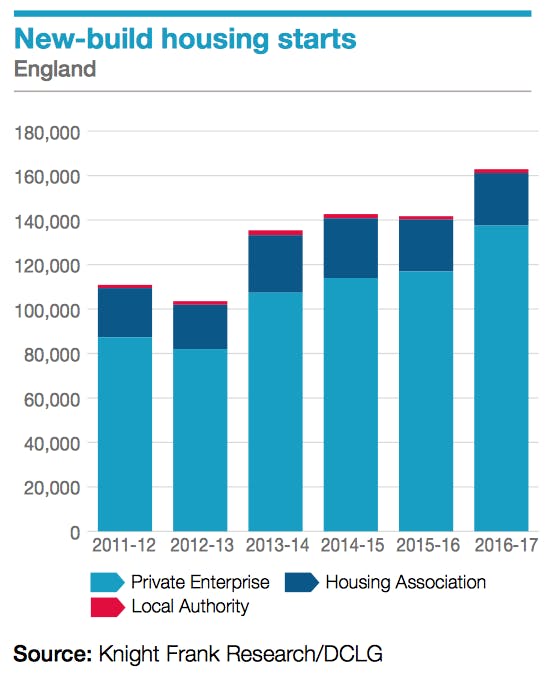

As we discovered in the recent English Housing Survey, there's been a significant and sustained shift towards renting over home-ownership, with England's Private Rented Sector doubling in size in the…

The Big Short (Let): Is Airbnb becoming the new buy-to-let?

There's been a huge jump in the number of properties being listed for short-term rental on "sharing economy" portals such as Airbnb, leading the Residential Landlords Association to ask "Is Airbnb becoming the…

Prime Central London stabilises, but it’s a divided market – JLL

There are "signs of stabilisation" in the Prime Central London sales arena, says JLL, as it reports growing transaction numbers and prices "holding firm" for the bulk of the market through the first half…

Cadogan Estate turns Victorian mews into one of the UK’s only PassivHaus homes

Three-year project culminates with picturesque 19th century mid-terrace on Pavilion Road achieving international low-energy performance standard...

Property price declines in Prime Central London fade as deal numbers rise

July data from Knight Frank indicates that the annual price change in PCL rose above -6% for the first time in ten months

Q2 was ‘the beginning of long-awaited stabilisation in the London rental market’

Foxtons reports an easing of rental value declines in PCL

International embassy staff drive a central London rental ‘surge’

Relocating diplomatic types are on the hunt for rental homes in Chelsea, Belgravia and St James's, reports agency