Economics

What economics has to say about housing bubbles

'Intuitively, a bubble (and this applies to any asset, not just real estate) exists when the price of an asset is over-inflated relative to some benchmark.

May Goes For June: Reactions to the calling of a snap General Election

"The lady is for turning" after all, says Trevor Abrahmsohn

Infography: All the homes in the world are worth $228tr

The average global home is valued at $82,000, says Savills

Buyers attempt ‘high-risk strategy’ of waiting for the bottom of the exchange rate

Knight Frank warns of the risks of linking a property purchase to the performance of currency markets

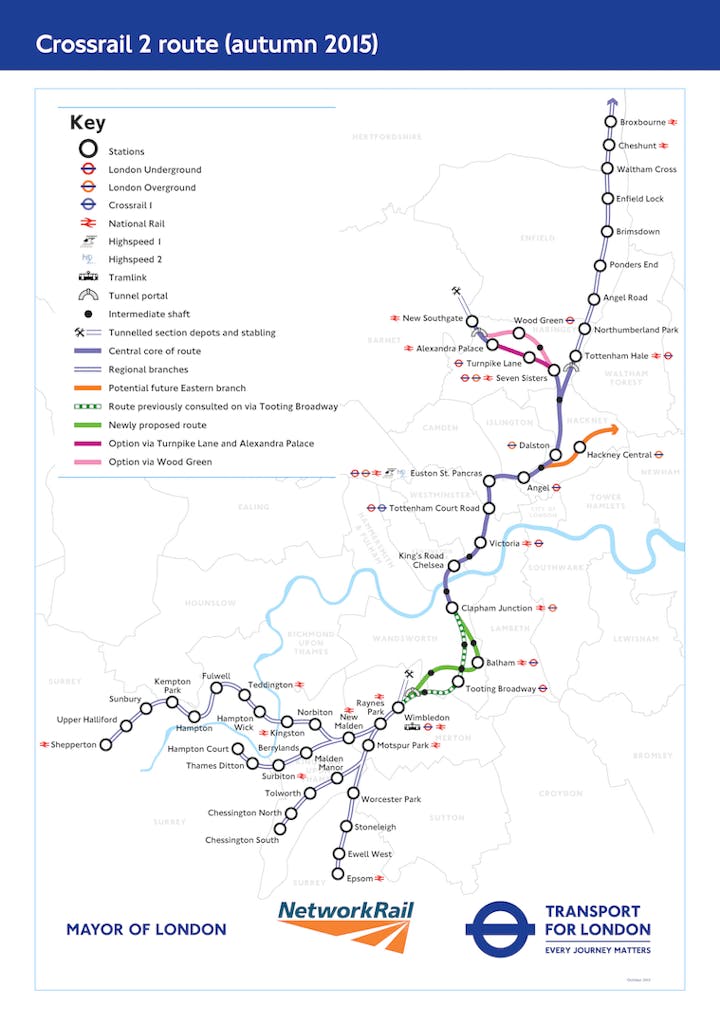

Crossrail 2 ‘vital to fixing housing crisis’ say developers

Giant infastructure project will 'give housebuilders the certainty they need'

Separation Anxiety: The economy, housing and Brexit

Former financier turned agency boss Charles Curran examines where a 'Norway Deal' - or access to the EU on a 'pay with no say' basis - would potentially leave the UK and its property market

Qatar to target UK real estate in £5bn investment push

Middle Eastern state already owns Harrods, the Olympic Village and 95% of the Shard

Top 40: Real estate billionaires

The richest property tycoons from the Forbes Billionaire List 2017

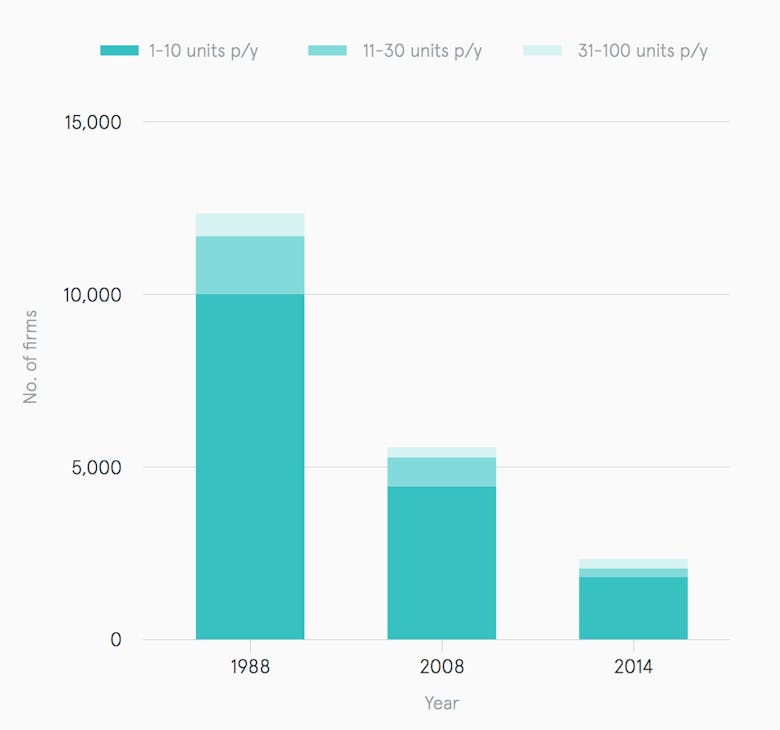

Four in five SME housebuilders have disappeared since the last housebuilding boom

Smaller developers need to be at the heart of Britain's housebuilding renaissance

Mortgaged home ownership dwindles to its lowest level since 1984 as the private rented sector balloons

English Housing Survey confirms the rise of rent, with the private rented sector doubling in size since 2004

Where is the ‘most desirable’ place to live in England?

Still a small town in the Wirral, apparently

Housing in London in 25 Graphs

Top takehomes from the Mayor's London Housing Strategy evidence base