Economics

In Suspense: Weighing up the positives and negatives of a hung parliament

The election result may have delivered yet more unwelcome uncertainty, but the prospect of a 'Soft Brexit' could be good news for both the economy and the housing market, says Charles Curran...

Ranked: The world’s top ten multi-millionaire cities

London tops the table for the most resident multi-millionaires and for HNW importance, but not for billionaire population

Millionaires say that now is ‘the most unpredictable period in history’

A survey of 3,000 millionaires Trumpets a dramatic claim - but HNWIs are still feeling positive

Capital Losses: CGT rule change would be ‘last straw’ for London’s prime property market

Imposing CGT on one's PPR would sound the death knell for the high-value markets of London, says Trevor Abrahmsohn...

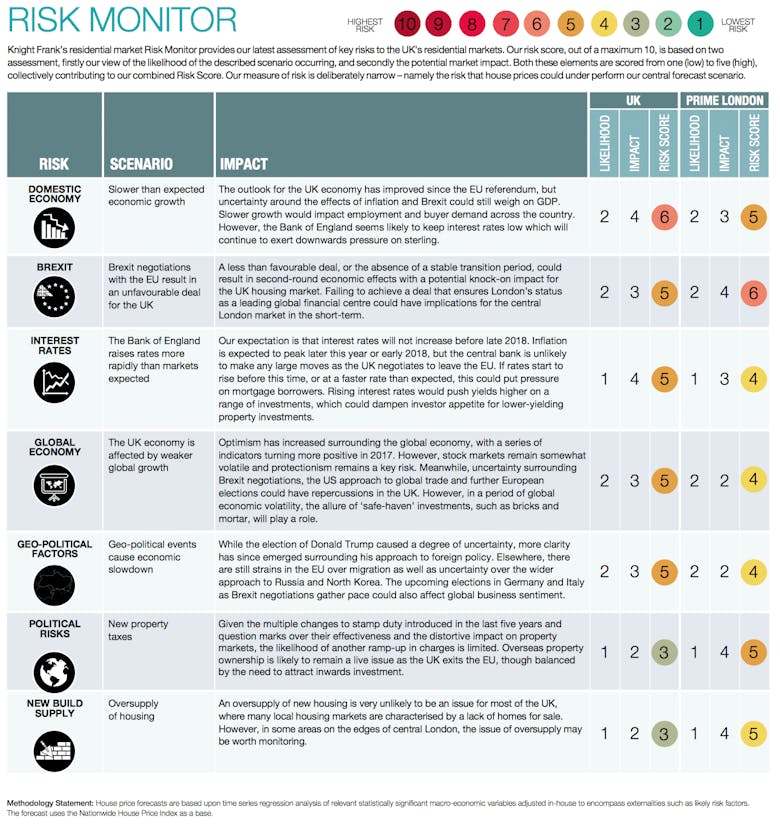

PCL’s slowdown to spread to Greater London this year – Knight Frank

Knight Frank mid-year forecasts indicate that everything will return to positive growth next year

The UK is sinking deeper into property inequality – here’s why

"The UK’s primary property tax remains scandalously out of line with modern property values", argues Tom Goodfellow

Why a strong May majority is good for property

'People will be happier to invest if sentiment is good'

What does Macron’s victory mean for France’s prime resi market?

En marche or bon marché?

Infography: Global property prices rise for the 16th consecutive quarter

But countries can be divided into three categories: Boom, Bust & Boom, and Boom

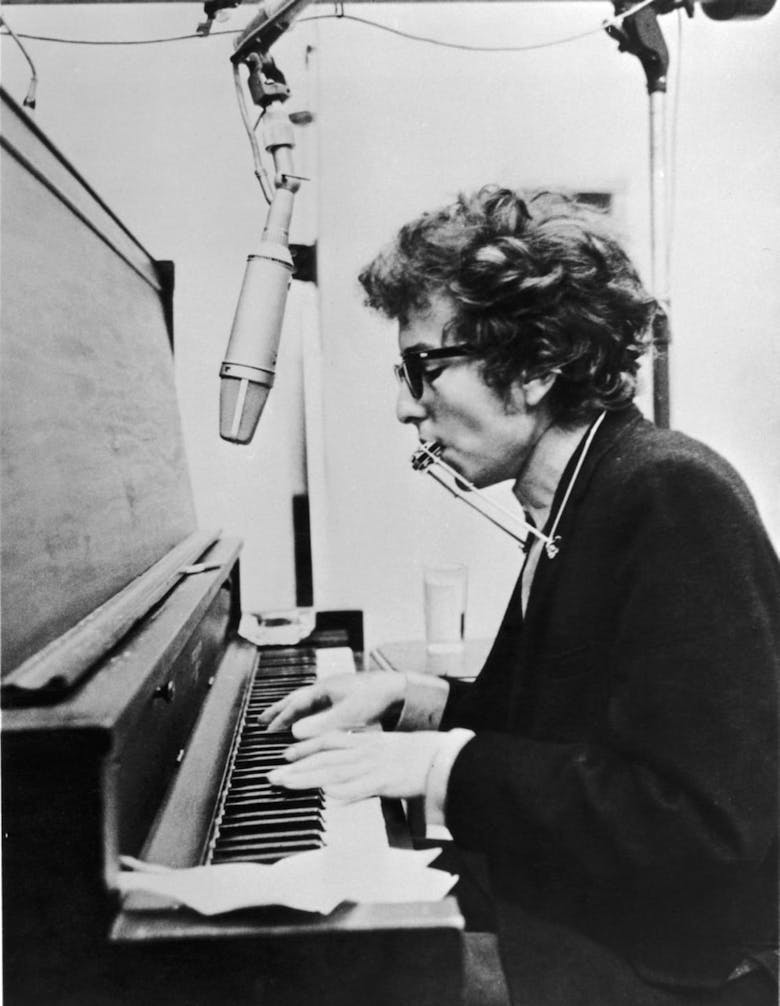

The Times They Are A-Changin’: A valuation viewpoint

Bob Dylan - with a little help from James Wyatt - explains how the world of estate agency and property valuation is changing

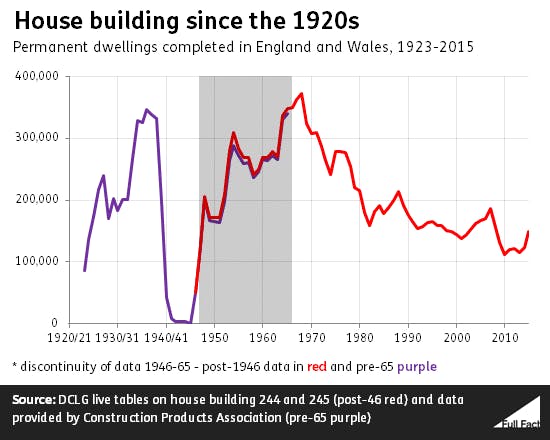

Election housebuilding stats, fact-checked

164,000 homes were completed in England in 2015/16. This is more than in recent years, but still below the 2007/08 pre-recession peak of 200,000

What economics has to say about housing bubbles

'Intuitively, a bubble (and this applies to any asset, not just real estate) exists when the price of an asset is over-inflated relative to some benchmark.