Economics

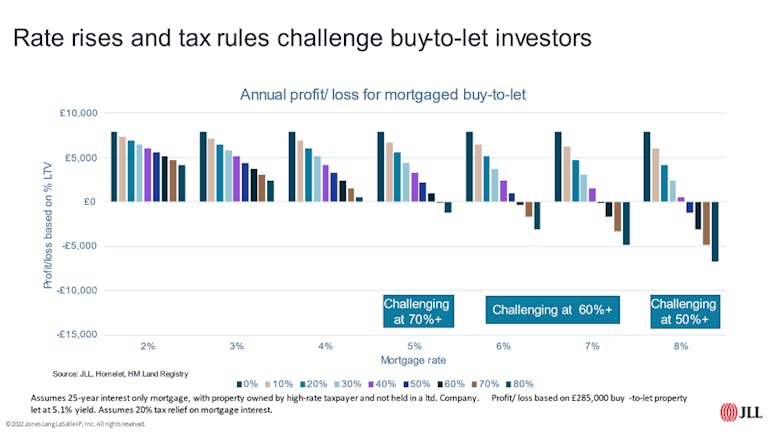

Marcus Dixon: In the eye of the mortgage storm

JLL's research chief looks into the repercussions of high and rising interest rates for residential property investors and their tenants.

Industry Reactions: UK HPI shows no change for the average house price in May

The annual rate of property price growth slowed from +3.2% in April to +1.9% in May, according to the UK's official House Price Index.

The number of retiree renters is set to double by 2030 as home-ownership rates ‘unwind’

Hamptons warns of 'significant social, economic and political consequences' thanks to an ageing population and a generational shift away from home ownership.

Mainstream property market sees ‘renewed deterioration’ as buyer enquiries fall again – RICS

'An important message coming back from RICS agents is around ensuring prices are set with an eye on the market conditions of today, rather than the recent past,' says the Institute's Chief Economist;

‘Holiday homes loophole’ to cost councils £170mn this year

'The problem is not second homeowners, it is politicians failing to understand the issues and having the courage to do something about it,' says top property agency.

Five parts of the economy that are hit when house prices fall

Finance professor Anandadeep Mandal explores what the UK's cooling housing market could mean for the wider economy.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Beauchamp Estates, ONS, The Buying Solution, OnTheMarket, Knight Frank & more...

Industry Reactions: Bank of England raises base interest rate to 5%

'If we don't raise rates now, it could be worse later,' explains Bank of England chief, as interest rates climb to a 15-year high.

Currency Matters: Pound nears 14-month highs against USD as rate hike looms

David Huggett runs through the latest movements and looks at the likely impact of another tumultuous week on the money markets...

Tom Bill: Nerves & mortgage rates rise ahead of inflation data & Bank decision

Rates are increasing as financial markets price in a period of more stubborn inflation, says Knight Frank's head of resi research.

Valuation Viewpoint: The future is here

Rapidly evolving tech will have profound implications for those in professional services, says James Wyatt.

Mortgage lending tumbled by 16% in Q1

'Lenders are all doing less business than they would like to be, and have shown willingness to absorb some volatility in order to remain competitive,' says Knight Frank Finance after checking the latest…