Legal

Irwin Mitchell boosts HNW offering with two new acquisitions

HNW advisory Berkeley Law and its separate resi property and conveyancing business, Berkeley Hurrell, have been snapped up by legal services giant Irwin Mitchell.

Required Reading: High value residential property and the Immigration Act

The requirement for landlords to undertake immigration checks presents a number of practical points that will have particular relevance to high value resi lettings, says Jane Reyersbach...

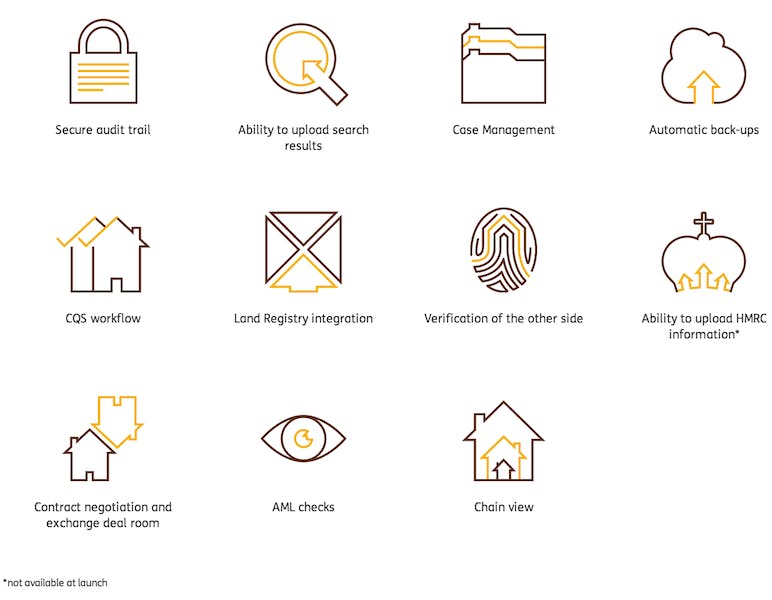

Conveyancing mega-portal unveils brand and gears up for Spring launch

The conveyancing world could be in for a major online shake up when the Law Society's new venture goes live in the Spring.

BP Collins adds four more lawyers to its property team

Buckinghamshire law firm BP Collins LLP has boosted its burgeoning property team with the appointment of four new associates.

MIPIM Notes #4/Final Thoughts: Nicky Richmond on FOMO

Nicky Richmond assesses the inaugural MIPIM UK from a property lawyer's point of view and asks 'what is it good for?'

Tempted as I am to finish the line of that song, it would not be entirely accurate.

Intellectual Property & Development: On architectural drawings and copyright law

The course of property development never did run smooth, but the oft-overlooked issue of copyright in relation to architectural design can be a particularly thorny one.

Law Review: Mind your PRS, Thames Tideway & Transfers of Going Concerns

Mishcon de Reya's handy round-up of the latest changes in the real estate legal landscape.

Required Reading: Potential Office-to-Resi Pitfalls

The latest set of planning reforms propose to make office-to-resi development rights a permanent fixture and leave the door open for other ‘something-to-resi’ conversions.

‘Legal battle’ over US Embassy redevelopment

Tempers appear to be fraying in Grosvenor Square over the redevelopment of the US Embassy building, or rather the lack of it...

£16k penalty doled out to developer after traffic breach

A developer working on scheme in North Kensington has been fined £9k and ordered to pay nearly £7k in costs after breaching its construction traffic management plan.

New Head of Resi Property for Taylor Wessing

Law firm Taylor Wessing has made two new partner hires to its Private Client practice in London, including a new Head of Resi Property.

The ‘unwelcome’ HMRC announcement creating yet more uncertainty for foreign investors

Made without any form of consultation, HMRC’s recent announcement on borrowing taken by non-UK domiciliaries and secured on their foreign assets has created yet more uncertainty for those looking…