Investment

Europe’s decade-long residential property bull run is ‘under strong pressure’

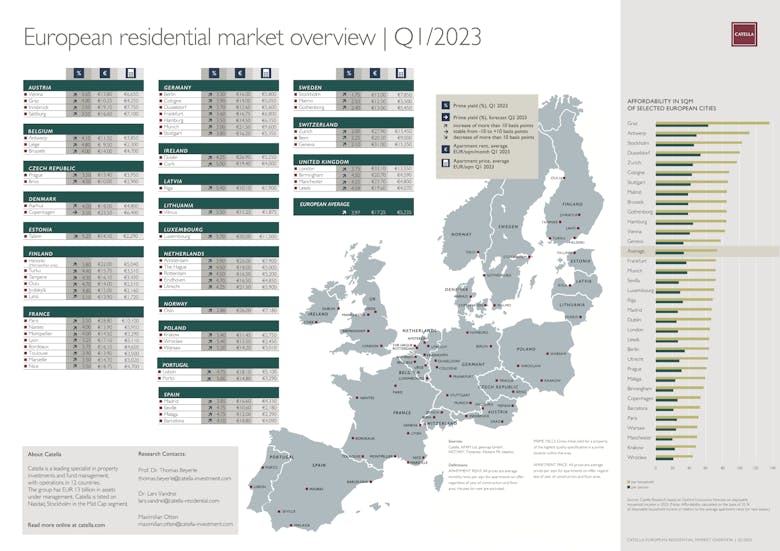

Resi valuations across Europe are 'stagnating due to the wide gap in expectations between most buyers and sellers,' says Catella Research, but a new 'lower consensus price floor' is emerging.

Berlin, Toronto & Paris have the world’s most ‘climate resilient’ city real estate markets, says Savills

'Investors may increasingly seek more resilient and green real estate in climate stable cities,' says Savills, 'but at the moment they will be competing over relatively few buildings that meet all those…

£8bn of capital heading for UK’s single family housing sector

'Single family housing is anticipated to play a far more significant role both in housing delivery and institutional real estate portfolios over the coming years,' predicts Knight Frank, as investment…

Currency matters: The banking sector sneezed, but no one seemed to catch a cold. Yet.

David Huggett updates on the latest movements on the world's financial markets, and how the recent turmoil might affect international investors in the UK...

Demand for development land stalls as borrowing costs climb

'The residential development land market has changed completely in the last year,' says Patrick Eve of Savills.

Grosvenor to double global indirect property investment portfolio to £1.5bn

'Our expansion plans will broaden our international property footprint, complementing our core direct holdings in the UK and North America,' says Mark Preston.

Higher borrowing costs force a ‘change in strategy for landlords’

'Investors are having to dig deeper into their savings to ensure the sums stack up on any new buy-to-lets,' says Hamptons.

Art looks good to investors as values outperform other luxury assets

Knight Frank’s Luxury Investment Index comfortably out-performed most other asset classes last year, posting 16% growth through 2022.

Cambridge named top UK city for resi investors

London languishes below Scottish cities including Glasgow and Edinburgh in the latest Colliers investment rankings.

The rise of corporate landlords: How they are swallowing city centres like Manchester one block of flats at a time

The housing prospects for young people in the UK were completely changed by the global financial crisis of 2007-09, write Adam Leaver, Jonathan Silver, and Richard Goulding of the University of Sheffield.

‘A seismic evolution’: Second Generation build-to-rent developments ‘feel more like lifestyle hotels’

Knight Frank's Oliver Heywood highlights the latest trends shaping Britain's burgeoning BtR sector - following a 'seismic evolution' in recent years.

Agents report ‘noticeably less competition’ for development land

Major housebuilders have cut back on land buying in an effort to ride out the weaker sales market, says Savills, with some pausing activity altogether.