Investment

Landlords’ average capital gain sinks again

Landlords who sold a property in 2019 typically owned it for 9.1 years and sold it for £78,100 more than they paid for it.

Pensions are worth more than property for the first time

The average UK house price is now £230,000, while the average final salary pension pot is worth £233,000...

Zoopla owner backs Airbnb, as holiday platform amps up long-term rental offering

Short-term rental platform secures $1bn investment; reveals a plan to "focus on long-term stays".

Threat & Opportunity: How proptech can drive sustainability in the built environment

"Technologists, entrepreneurs and investment leaders are increasingly identifying sustainability as the defining issue of our times," says Faisal Butt, founder of PropTech investment house Pi Labs.

Pi Labs backs five more proptech start-ups, as accelerator programme goes virtual

Structor.io, REST Solution, Hausbots, Bright Spaces and Propster have been backed by Faisal Butt's PropTech VC firm.

Infography: Comparing ‘Black Swan’ crisis events

The Covid-19 outbreak is being called a "Black Swan" event - something rare and unexpected that has severe consequences for investors.

Pi Labs bags £2.5m to fund global expansion

PropTech investment firm plans to double the number of companies it backs.

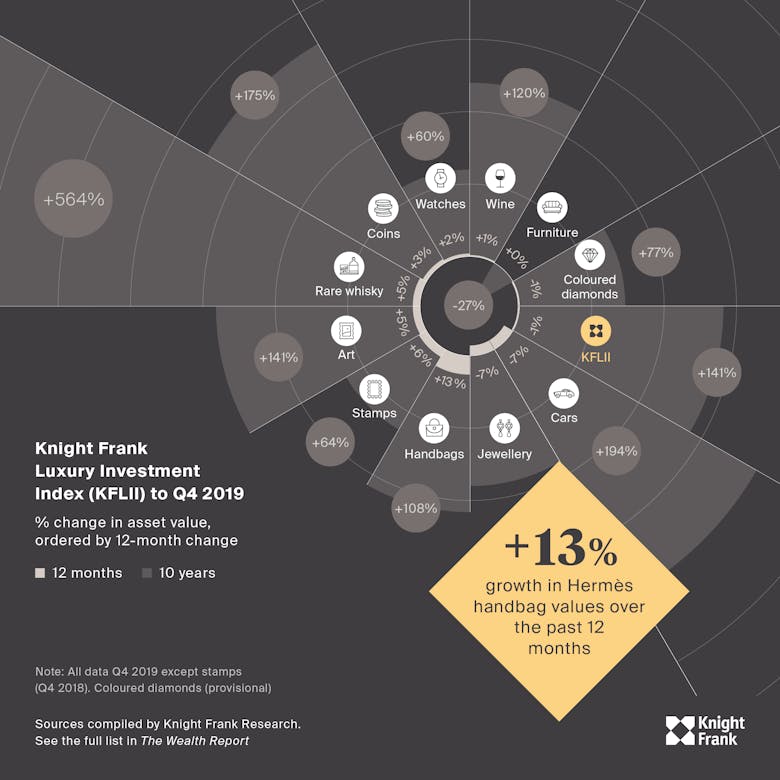

Ranked: This year’s top performing passion assets

Knight Frank's Luxury Investment Index sank in value by 1% in 2019 - but some collectibles did manage to bag decent growth...

Decade of Virtue: Liam Bailey on the seismic rise of ESG, wellness & impact investing

As Knight Frank publishes its 14th Wealth Report, Global Head of Research Liam Bailey explores the big theme dominating the high net worth agenda right now: "the seismic change being brought about through…

‘I hope no one ever experiences what I have been through’: High-profile developer falls victim to ‘multimillion pound property scam’

High-profile developer, writer and podcaster Nicole Bremner has expressed her shock at being targeted in a "multimillion pound property scam".

UK leads the way as PropTech investment ‘reaches critical mass’

"The PropTech movement is reaching a critical mass," says Professor Baum of Oxford Saïd Business School. "Regulatory roadblocks remain, but the first companies to overcome them will reap huge rewards.

Daejan moves back to private ownership

£270m share swoop to take the Freshwater family's investment vehicle back into private ownership for the first time in 60 years.