Finance

Institutional property investors get CGT exemption

The Government's consultation into the "significant reform" of the Capital Gains Tax system, which looked out at how far non-resident property buyers will be hit, concluded last week.

INTERVIEW: Triangle Group’s Rick Denton on buying Holborn Links and building investments

Prized four-acre swathe of London's Midtown bought in one of the biggest deals of 2014 so far

Hadley completes Chelsea Island acquisition with £48m bridge

Luxury developer Hadley Property Group has completed the acquisition of a prime development site next to the Chelsea Design Centre in Chelsea Harbour with a chunky bridging loan from Omni Capital.

Chinese investment into London resi leaps 84% in a year

Outbound investment from China to London has ballooned over the last 12 months, making it the most popular global destination for Chinese investment after a series of pushes from Mayor Boris et al to make…

Harrods Bank joins the CML

Harrods Bank - the independent private bank that operates out of the Knightsbridge shop and calls itself "one of London's best kept secrets" - is the latest firm to become a member of the Council of…

Dragonfly hits £1bn lending target

Alternative lender Dragonfly Property Finance has smashed the £1bn lending target it set itself back in 2009.

CIT bolsters Investments division with new MD

Private equity real estate behemoth CIT has just appointed Biren Amin to lead its Investments division.

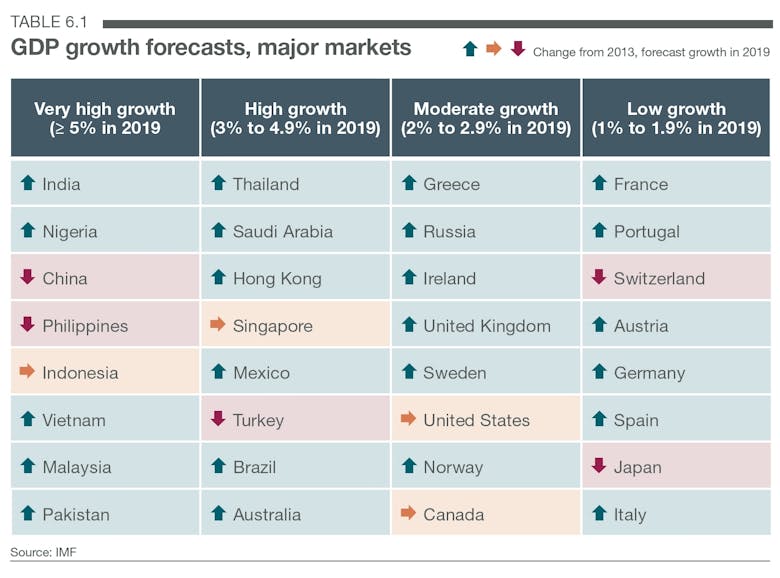

World in London #4: Who’s Next?

In the fourth and final part of Savills' World in London 2014 report, Yolande Barnes asks which nationalities will be making an impact on London's property market in five years' time.

How currency movements make the world’s luxury property markets go round

An 'attractive' exchange rate is often cited as a key motivator by international buyers, but exactly how much impact do these currency movements have on the world's prime residential property markets?

Mishcon launches luxury assets group

Mishcon de Reya has launched a new Luxury Assets Group to help out passionate investors with their classic cars, fine wines, jewels and other "non-financial investments."

Lender launches range of expat mortgages

A lender had just introduced a new range of buy-to-let mortgages designed with the British expat in mind.

68% of LPAs to miss April’s CIL charge date; ‘a significant impact on the delivery of housing’ likely

68% of local planning authorities won't have a CIL charge in place by the time Section 106 restrictions come in in April 2015, say Savills and the Federation of Master Builders.