Finance

Dragonfly boss flies the nest

Property finance outfit Dragonfly has a new CEO.

The firm's Head of Sales and Marketing Mark Posniak has replaced Jonathan Samuels, who's left to start a new (non-property related) venture.

Australian government forces more sales in $1bn foreign investor crackdown

The Australian government's new crackdown on "illegal" overseas investors has already started snaring some pretty big fish.

Owners of residences in Sydney's exclusive Elizabeth Bay are under scrutiny

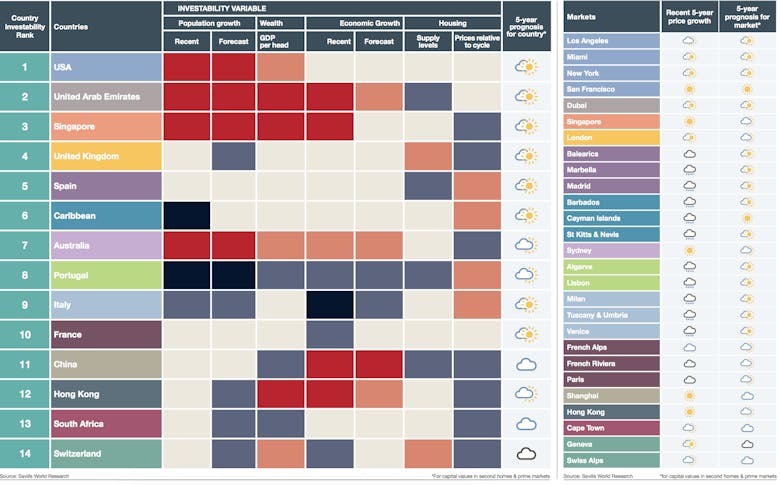

USA is the world’s ‘clear number one’ for residential investability – Savills

"Investors in international residential real estate should combine an understanding of macro metrics and an appreciation of local, shorter term drivers of house prices when making buying decisions," says Savills as…

Pension freedoms aren’t creating an over 55’s property bonanza

Future dealings in the property market by householders currently over the age of 55 will account for more than three million property transactions, worth a total of more than £775bn, says the Prudential.

Rowsley’s first Euro play backs Neville and Giggs’ ‘new Mayfair of Manchester’

Peter Lim, the Singapore-based billionaire part-owner of Salford City FC, has agreed to back football stars Gary Neville and Ryan Giggs' plans to develop a former police station in central Manchester into…

LCP launches new fund with 50-property ‘seed portfolio’

London Central Portfolio has just announced the launch of its "super fund", LCA III, which comes with a "seed portfolio" of 50 properties already in place.

Private Finance goes on broker recruitment drive as referrals rocket

Mortgage broker Private Finance is ramping up its team to deal with an increase in referrals from Strutt & Parker.

Appetite for long-term mortgages soars as August heats up

The number of homebuyers looking to secure a 30+ year mortgage has jumped from just 8% a year ago to 21% in Q2 2015, according to broker Mortgage Advice Bureau.

Luxury asset lender enters the prime resi arena

An online platform that lets people borrow cash by putting their luxury assets up as collateral is apparently poised to make a "big splash" in the prime and super-prime resi sector.

High Performance: Classic car trumps country estate and UK resi as best investment

The classic car has come out top of the asset classes again this year, but the country estate has now moved into second position.

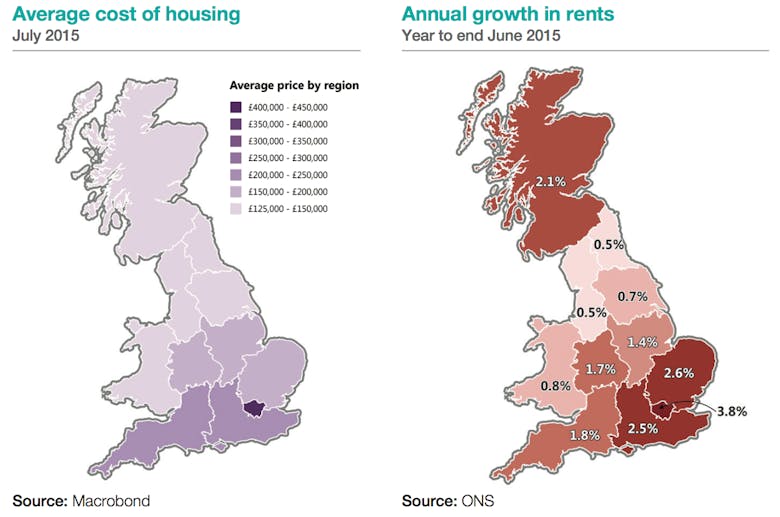

Rise of the Renters: Yields tighten as PRS sector blooms

Regional cities outside of London have been the driving force in a significant lift in the number of households in the private rented sector (PRS) over the last decade, says Knight Frank, but yields across…

GB household property debt hits £1 trillion

Total household property debt was estimated to be £1 trillion in 2010 to 2012, up from £980 billion in 2008 to 2010, according to a new report from the ONS.