Finance

The Rain in Spain: European decision bad news for holiday home owners

Owners to sacrifice the money they unfairly paid on their mortgages to bailout the country's ailing banks

Vancouver brings in 15% non-resident tax to put the brakes on the property market

The British Columbia Government in Canada has rubber-stamped a 15% levy on foreign buyers of Vancouver property, in a bid to thwart spiralling house prices - but it's given the industry just eight days'…

Chinese buyer enquiries ‘up 30-40%’ post-Brexit

No 1 Chinese property portal Juwai.com has also sent in some useful post-Brexit observations.

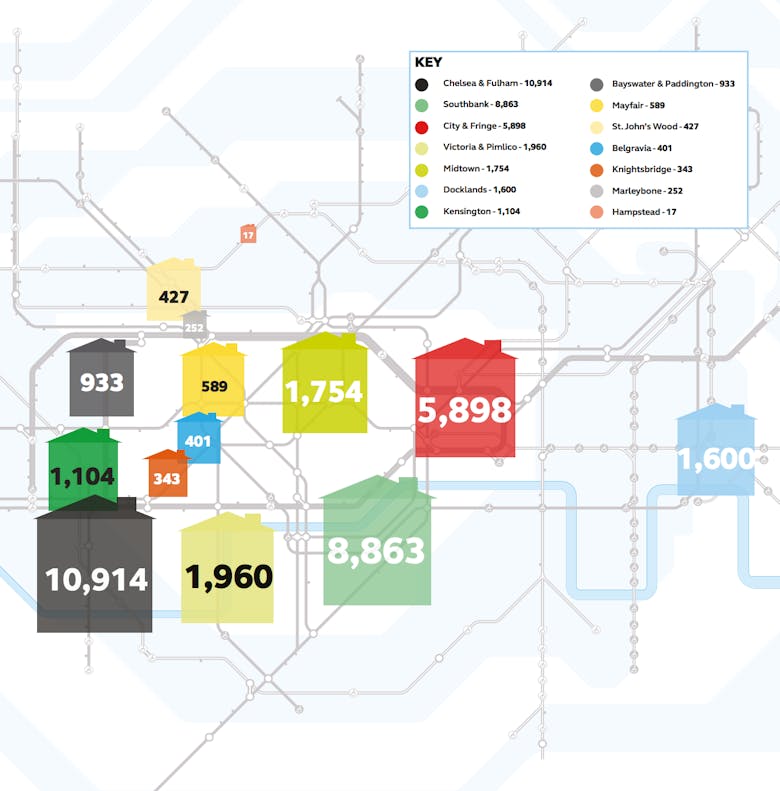

Eaton Square development project goes crowdfunding for £1m

Renovation project on Belgravia's ultra-exclusive Eaton Square

Finchatton founders launch ‘institutional grade’ property crowdfunding platform

Alex Michelin and Andrew Dunn have teamed up with fin-tech star Uma Rajah

Disputes: New tribunal decision bad news for landlords

Could have a big impact

Why property financiers must keep calm and carry on lending

The future of the UK property market depends on whether markets, lenders, investors and developers choose to trade on negative sentiment, as opposed to the strong underlying fundamentals, says Randeesh…

‘Opportunistic’ prime London fund reports strong results

Targeting the "buoyant" Private Rented Sector

£500m loan puts Wanda’s One Nine Elms back on track

Chinese bank Ping An has agreed to dish out the dosh - with a £100m initial drawdown

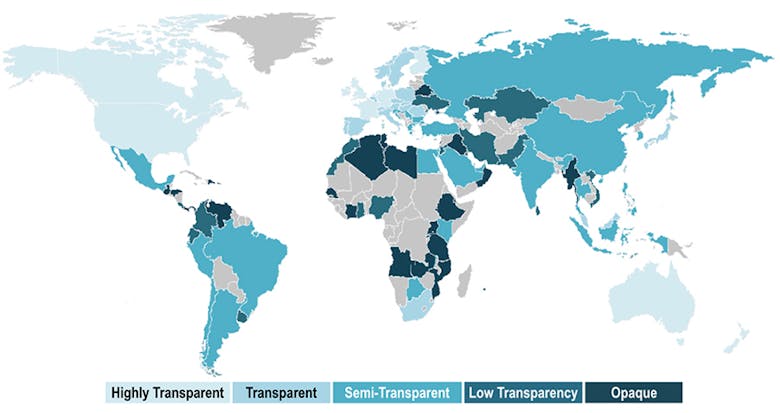

Ranked: The world’s most transparent real estate markets

A new report has ranked 109 of the world's real estate markets according to their transparency.

Gross annual bridging lending hits £3.6bn

Gross annual bridging lending in the UK has risen to £3.6bn, according to the latest West One Bridging Index, up from £3.5bn at the end of 2015.

Current market conditions ‘ripe for opportunistic foreign investors’

Development consultancy Arcadis has joined the voices predicting a boost for the UK's prime resi market as sterling continues to take a beating in the wake of the Brexit vote.