Finance

Prime property crowdfunding platform opens up to corporate investors

CapitalRise launched in July, and has raised funds for projects on Eaton Square and Grosvenor Square

London, New York & Singapore are favourite destinations for Middle Eastern investors

11% of those surveyed by Cluttons put the UK capital at the top of their global wishlist

‘Game-changing’ offshore data opens UK tax avoiders to ‘tough new sanctions’

HMRC is getting wide-ranging access to account-holder information from the Crown Dependencies and Overseas Territories from October

Vancouver just hit foreign buyers with a new tax; here’s what happened next…

Locals and foreigners alike have "stopped pursuing deals" as the market reacts to the levy

Blackstone fills last two spaces in the NCP carpark race

Just two players are left battling it out for the £500m fleet of properties

Treasury pushes on with plan to abolish non-dom status and charge IHT on enveloped property

The government is pushing ahead with reforms to non-dom tax policy initially announced in George Osborne's Summer 2015 Budget, launching another consultation despite some mutterings that it might all…

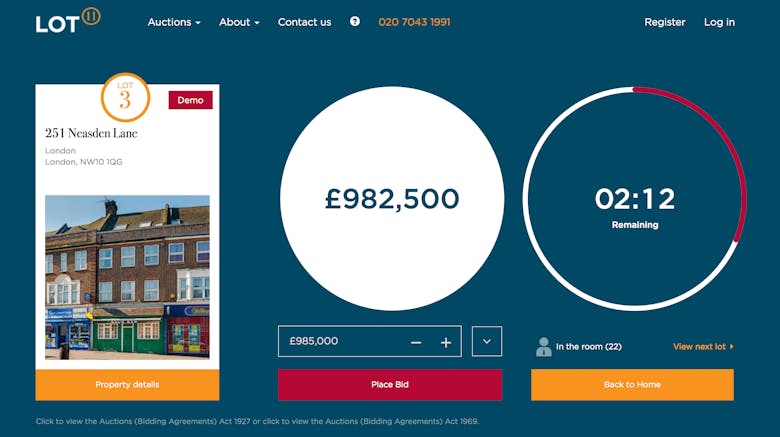

Lender teams up with online auction house to pre-qualify lots for finance

Trumpeted as "an industry first"

Central London’s ‘new-build crisis’: Over-supply and falling values are ‘a major concern’

Demand seems to be drying up for new-build apartments in central London as planning pipelines balloon, reports investment house London Central Portfolio, with a worsening case of over-supply - which the…

Learning Potential: Edinburgh, Bristol & Brighton named UK’s ‘most lucrative’ University cities

Edinburgh offers the best prospects in the UK for those looking to invest in student accommodation, according to new research by Chestertons.

Fortwell brings on two new senior players to the development finance team

High-value short-term real estate lender Fortwell Capital has created and filled a new Head of Development Finance role, and recruited a new Senior Analyst to the development finance team.

Exclusive Pictures: £18.8m show flat on Grosvenor Square goes crowdfunding

Fresh from raising £1m in just eight days to fund a renovation project on Eaton Square, new high-end property crowdfunding platform CapitalRise has gone even more up-market with its second investment…

Crowdfunded Eaton Square development raises full £1m in just eight days

CapitalRise has already closed its first deal