Finance

‘Bank of Mum & Dad’ shelled out almost £9bn to first-time property buyers in 2022

Nearly half of all mortgaged first-time buyers relied on family money to get on the property ladder last year - and Savills expects this proportion to rise to three in five as Help to Buy ends.

Budget Explainer: Here are some ways to read between the lines on what’s being reported

Simon Wren-Lewis, an Economics Professor at the University of Oxford, explores how media coverage of government finances and Budget statements can be confusing, and often misleading - highlighting some…

Last minute £22mn loan salvages west London development scheme

Developer nearly lost a £12mn deposit.

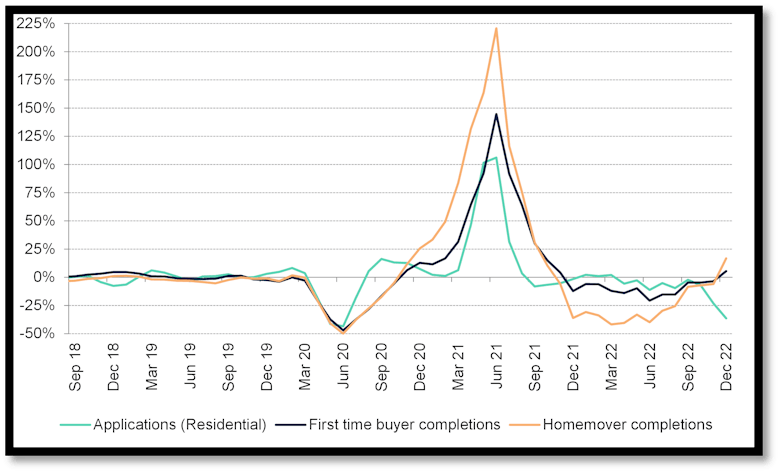

UK mortgage applications fell sharply in the final quarter of 2022

Fresh data from UK Finance and Accenture confirms the sharp drop in house-buying and consumer confidence following the ill-fated mini Budget.

NatWest pledges £100mn funding line to top-end lender

Paul Munford's Century Capital secures access to 'further firepower' as it targets the 'mass affluent' regions of London & the Home Counties.

Knight Frank Finance inks tie-up with major insurance firm

Gallagher has been appointed as the agency's dedicated insurance broker.

Mortgage lending falls again as the housing market ‘suffers a prolonged hangover from the mini-Budget’

'There remains a huge amount of nervousness among borrowers, who aren't sure which way mortgage rates are likely to move next,' comments Knight Frank Finance on the latest BoE mortgage lending data.

HMRC warns of looming deadline for companies to revalue UK residential properties

ATED revaluations need to be completed by 1st April.

The New Prime: Charting the rise of ‘equity-have’ Vs ‘equity-have-not’ property markets in the UK

Significant proportions of the UK housing market now have little or no reliance on borrowing, says Yolande Barnes.

SDLT: Black and White, or (50) Shades of Grey?

Matt Spencer and Charlotte Jeanroy of Kingsley Napley explore the 'wonderfully complicated' world of Stamp Duty, highlighting a number of legitimate ways buyers can mitigate their transaction tax burden.

PCL is an attractive opportunity for the US investor, but for how long?

David Huggett explains the events that led to a 'once in a lifetime' opportunity for international buyers last year, and why the latest shift in currency markets could signal another turning point.

Coreco acquires West London mortgage consultancy

Hogarth Property Group has sold Paul Alexander Mortgage Consultants.