Finance

Boris launches database of development opps; Invites developers to “bombard” him with great ideas

London Mayor Boris Johnson has announced the launch of a "GLA Land Assets Database" today, in a bid for greater amounts of public land to be released for development.

Stamp Duty: one year on… Sales drop but Revenue’s revenue rises

With the countdown to the 2013 Budget underway, Knight Frank's Head of Residential Research Liam Bailey looks at the impact last year’s increase in Stamp Duty has had on the market, finding that, whilst…

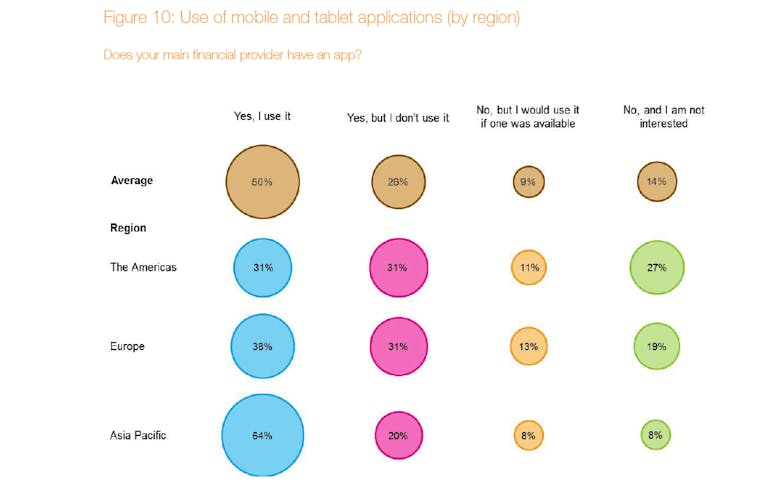

Futurewealth #3: helpful investment technologies

In the third in-depth report of the series, wealth gurus Scorpio Partnership explore how investment advisors and the Futurewealthy use technology to discover, inform and deliver investments.

US leads way as Billionaire Club booms

If you're looking for a few fillers on your "New Business Targets" spreadsheet, the 27th annual Forbes World's Billionaires list is out, featuring 1,426 ultra-high-powered names with an aggregate net worth…

London drives strong investor returns as UK resi portfolios deliver 8.9%

Residential investment continues to outperform inflation and commercial real estate, according to the latest IPD UK Annual Residential Property Index, with returns from portfolios in the private rented…

ABC launches unlimited resi bridge loan

Short-term commercial lending specialist Alternative Bridging Corporation (ABC) is going big on the residential market, launching a new bridging loan product targeting prime resi projects.

Bankers’ bonuses capped at one year’s salary

The EU has provisionally agreed - after many moons of wrangling and staunch opposition from George Osborne - to limit bankers' bonuses to one year's salary, or two years' if there is explicit approval…

Earl’s Court scheme leads strong year-end performance for Capco

London property titan Capco has released 2012 year-end results, and they're pretty strong.

Cash buyers crash out of the prime central London market

The proportion of cash buyers in prime central London has slumped from 74% in 2011 to 49% in 2012, according to the latest (well-timed) report from Cluttons.

Bankers’ bonuses: The property industry reacts

Savills estimates that prime London housing markets have benefited from £23 billion of bonus money from the financial and insurance services sector over the past ten years, with a further £14 billion…

Currency Counts: Big savings for international buyers as London continues to appeal

Winkworth has shrewdly mapped out by exactly how much international buyers are benefiting from Sterling's slide, with Moody's downgrade tipped to stimulate yet more interest in the capital's property market.

What does April’s new Capital Gains Tax mean for high value UK property?

Corporate owners of £2m+ properties in the UK need to act now to stay on top of the latest tax regime changes, say Andrew Goldstone, Kassim Meghjee and Jonathan Legg of Mishcon de Reya.