Finance

Auriens Chelsea completes on £140mn refinancing deal

Luxury retirement living developer's new management team says the long-term finance package 'demonstrates the market’s confidence in its bright future.'

Behind the numbers: How many non-doms will be affected by next year’s changes?

Savills estimates that 22,100 non-doms are likely to be exposed to proposed tax changes.

Second home owners sell-up following Welsh Council Tax hike

'We're seeing properties come on the market at such a volume that I've never seen in 30 years,' says one Welsh estate agency owner.

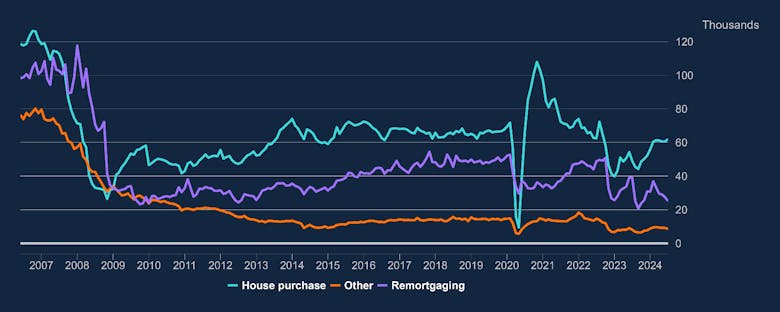

BoE heralds ‘optimism’ as mortgage lending picks up

Mortgage lending has hit the highest level since November 2022.

October’s Budget ‘is going to be painful’, warns Starmer

'Those with the broadest shoulders should bear the heaviest burden,' said the Prime Minister.

Bridging lending climbs to another record high

Short-term property finance is becoming more prevalent.

‘Council tax & stamp duty are unpopular, unfair & impractical’: Pressure builds for drastic property tax reform

A former advisor to Rishi Sunak - who also devised the Covid furlough scheme - has come up with 'a practical alternative to replace Stamp Duty & Council Tax'.

Home-buyers turn to short-term finance to save sales chains

Growth in bridging loans 'seems to be fuelled by the urgent need to prevent chain breaks in property transactions,' say lenders.

Property finance firm GB Bank appoints new CEO to lead expansion

The specialist bank, which is backed by Clivedale founder Sameer Gehlaut's Hera Holdings, aims to double its workforce this year.

Developer secures £6.3mn enfranchisement loan for Mayfair townhouse project

Funds secured from CapitalRise and Colliers will be used to acquire the freehold title of a mixed-use building on South Audley Street, with a view to creating a super-prime resi scheme.

Strutt & Parker owner set to buy AXA IM for €5.1bn

BNP Paribas Group is in exclusive talks to acquire AXA Investment Managers, in a deal that would create a European finance behemoth with €1,500bn of assets under management.

Industry Reactions: BoE cuts interest rate to 5%

Property industry insiders express relief at the first base rate reduction in more than four years.