A fifth of homes have seen values rise by more than the average UK salary in the last year

Zoopla estimates that 4.6 million private homes in the UK rose in value by more than £30,500, the average UK salary, in the last year. That's 21% of all privately owned homes in the country.

‘We suspect house prices will rise only 1% over the year and would not be at all surprised if they stagnate’ – EY

EY's Spring ITEM Club predicts muted property price growth ahead, with a 'limited' upside even if a Brexit deal is agreed. A no deal exit could see house prices fall by 5% in 2020

By PrimeResi

The Rise of ‘Necrotecture’: Half of London’s new-build homes are underused, claims academic

And 64% of London homes worth more than £5m are "empty", according to a new study by Rowland Atkinson, Chair of Inclusive Studies at Sheffield University

By PrimeResi

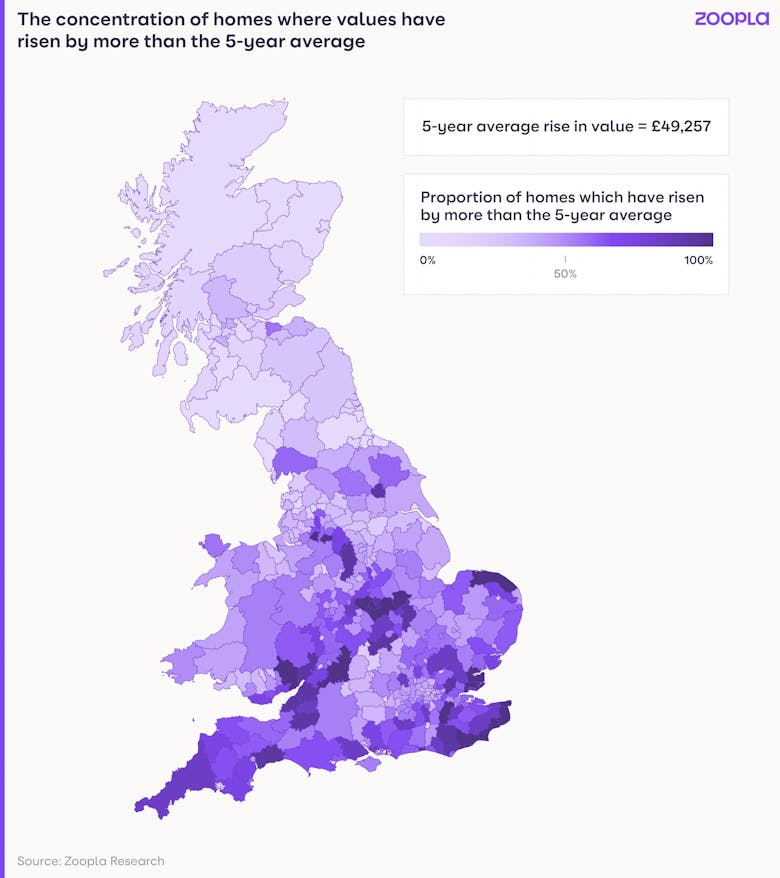

The total value of British homes has climbed by £1.6 trillion in the last five years

A sharp acceleration in property price inflation means that the combined value of British homes has climbed by £550 billion (a third of the total five-year increase) in just the last 12 months, according…

By PrimeResi

Companies in this article

ZooplaMost read

Interview: Inside Strutt & Parker’s big bet on a ‘hybrid’ broker model

Exclusive: Sales chief Claire Reynolds explains how the agency's new brokerage will operate alongside traditional offices, what the move could unlock, and what it says about the industry’s evolution.

St James’s Square trophy emerges from five-year ultra-luxe overhaul

Developer Henigman says freehold Lutyens mansion offers 'rare, generational opportunity to own one of the world’s finest residences'.

Success storeys: Top four development sales launches of last year revealed

Difficult market conditions haven't held these 'landmark' central London schemes back.

RBKC approves 100% premium on second homes

Bills to double from 2026/27 as council moves to address £100mn-plus funding gap.

In Pictures: ‘World-renowned’ Scottish estate seeks £67mn

Tulchan is one of the great Highland estates. 'The opportunity it offers is unmatched in Scotland today,' says Savills.

By PrimeResi

Property prices are already ‘bunching’ around new mansion tax thresholds

'Some sellers are adjusting asking prices downwards,' reports big agency, as pricing strategies adapt to keep properties below the £2mn mark.

By PrimeResi

British property mogul reportedly sells $55mn NYC townhouse

One Hyde Park co-creator is said to have sold the property after acquiring a Midtown penthouse.

Strutt & Parker recruits Savills’ Hampstead sales head

Heritage agency boosts new broker network with senior north London hire.

Prime property listening: five industry podcasts worth tuning into

Catch up on conversations with resi insiders in PrimeResi's regular round-up, featuring episodes from Knight Frank, Russell Simpson, Strutt & Parker & more...

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Andrew Thomas, a Lecturer in Middle East Studies and author of Iran and the West: A Non-Western Approach to Foreign Policy, explores 'a deliberate strategy by the Iranian government, designed to exact…

LATEST ARTICLES

OBR updates UK housing market forecasts

Average prices & transaction volumes likely to rise 2.5% a year over the next five years, while housebuilding activity is set to dip further before turning up 'sharply'.

By PrimeResi

Talking Heads: Property industry reactions to the Chancellor’s Spring Statement 2026

Deliberately low-key speech broadly welcomed by prime resi insiders.

By PrimeResi

Super-prime rental deals surge in London

£5,000-per-week-plus tenancies up 8% year-on-year as internationally mobile tenants prioritise flexibility.

Cluttons names new Head of Residential Management

Wayne Stanley was previously in charge of resi management for Howard de Walden Estates in Prime Central London.

By PrimeResi

In Pictures: One of London’s oldest houses comes to market

Rare 17th-century survivor just off the Strand recently returned to resi use.